It may be decades before we can assess the full transformation that Covid-19 imposes on American society. But one area of policymaking could already be on a trajectory for big change: The way we think about recessions.

Years before they were included among the measures Congress passed in its $2.2 trillion stimulus package, several of the bill’s proposals had been gestating among a group of economists who want to rethink the basic way that we fight recessions. These thinkers, from think tanks, academia, and government institutions, argue that policymakers should take measures to recession-proof the American economy—not to eliminate economic contractions but to dampen and shorten their effects.

The cornerstone of these ideas is timing. Recessions can be predicted, these economists argue. Wielding this insight, policymakers can design a system that enacts fiscal and monetary measures automatically, before a recession is formally declared. These measures, known as automatic stabilizers, resemble something like the trip-wire system that shuts down trading on Wall Street during crisis events.

Automatic stabilizers are nothing new—one presidential candidate, Michael Bennet, even made them part of his policy platform—but in the pandemic era, they might finally get the attention these researchers have sought. One of these economists is Dr. Heather Boushey, who leads the Washington Center for Equitable Growth, a DC think-tank co-founded with John Podesta. Along with senior Brookings economists Jay Shambough and Ryan Nunn, Boushey published a compendium of these ideas, called Recession Ready, last spring. The book contains six ideas for recession-proofing the economy, each activated automatically by different economic trip-wires.

In an interview edited for length and clarity, Boushey discusses why these ideas might finally be catching on, and how our current crisis might look different in a world of automatic stabilizers.

Can you sketch the typical way we think about recessions and the fiscal and monetary tools we use to fight them?

Heather Boushey: Typically when we see recessions—when the economy is contracting, firms laying off workers, producing less in terms of goods and services—then the federal government has essentially two tools. One is that they can use monetary policy, lowering the cost of borrowing, and in doing so encourage businesses to take on more loans. The other tool is to use fiscal policy, to have the government spend more money than it brings in, in order to ramp up consumption. Fiscal policy can really help to keep the money flowing through the economy. So the government can give unemployment benefits to everyone out of work; they can increase the amount of money to people who need food assistance. Those are some examples of what we do in a typical recession.

And the key element is timing—which is the key insight of the book, too. You basically point out that in a typical recession, we’re acting retroactively. We’re always fighting the fire behind us, not the one in front.

Exactly. I think what happens is that a lot of times, when economists think about how to make economic policy, they seem to have in their imagination these all-seeing policymakers—who, as soon as they see the economy contracting, are going to go out and use their tools to bring the economy back online, back to its full capacity. And the reality is that politics is really complicated! And it’s messy. What if Congress is in recess? Maybe it’s August when an economic contraction starts.

Or, what if there’s a pandemic and Congress doesn’t want to come to Washington?

I was just about to say that! What if there are fast-moving conditions, which meant that you needed to act very quickly?

The other thing is, economists have been able to show with a pretty high degree of certainty what things work in a recession to address the macroeconomic problems. We have a lot of research evidence that says when the unemployment rate goes up, you want to give out more to the unemployed when they’re searching for jobs. We know that making sure the states are able to [avoid] cutting their spending can help mitigate the effects of a recession.

And since we know that these tools are really helpful, you can actually design a system where we automatically start pumping money out through the unemployment system, through direct payments to individuals, through increasing how much aid we give to the states, that can be calibrated to the economic cycle. And it can be turned on when the economy starts to contract, and turned off when the economy starts to expand again. What that does is to take the best learning from economics, and uses it to craft really effective policy to stabilize the economy during a downturn.

Right. So then the key issue is “seeing” the recession before it hits. But can we actually do that? I think a lot of people would be stunned to learn just how abysmal the track record is of top economists who try to predict recessions. Or that we really don’t have an agreed-upon definition of a recession, or when it’s started. Your book, for example, identifies different types of triggers for different interventions.

It’s such a great question. The definition of a recession isn’t just one variable. It’s when the economy contracts. It means a bunch of things are all happening at once. We don’t define it as when output falls by 5 percent or whatever. It’s not one indicator, it’s a compilation.

In our book, we focused on all the different things that have been really effective in mitigating prior recessions—what policies really work—and each of them is actually directed at a different part of the problem of what happens during a recession. So, for example, you can use the coronavirus pandemic to kind of see this: The crisis started first in Washington state. And those communities that were shuttered first had that first economic effect, right? So you had a lot of people that were social distancing, they were going home, businesses were shutting down. So that is a way of seeing that recessions aren’t national—they don’t happen everywhere at exactly the same time.

So the different ways that we thought about the policy options get at different aspects of the problem. A different kind of policy that can be very effective is giving people direct payments—sending everybody a check—and that can really be effective nationwide to boost consumer spending. The policies like infrastructure investment, or ensuring that state and local governments are doing well, those are targeted at slightly different aspects of the problem. But [those aren’t] going to be evenly distributed across the US like the direct payments would be.

Those are different policies and they’re targeted at slightly different aspects. But they’re all aspects of the same problem. The end result is that these triggers are going to go on at about the same time, and off at the same time.

I count four ideas in the stimulus bill that echo your book: Shoring up Medicaid, increasing food security, expanding UI benefits, and direct payments. Were any of these particularly exciting for you to see in the bill?

Let me just take one quick step back. This is not your usual recession. We haven’t seen anything like this in generations. It’s a unique kind of recession, because in the first instance, it’s being caused by government policymakers telling us, “Hey you need to go home.”

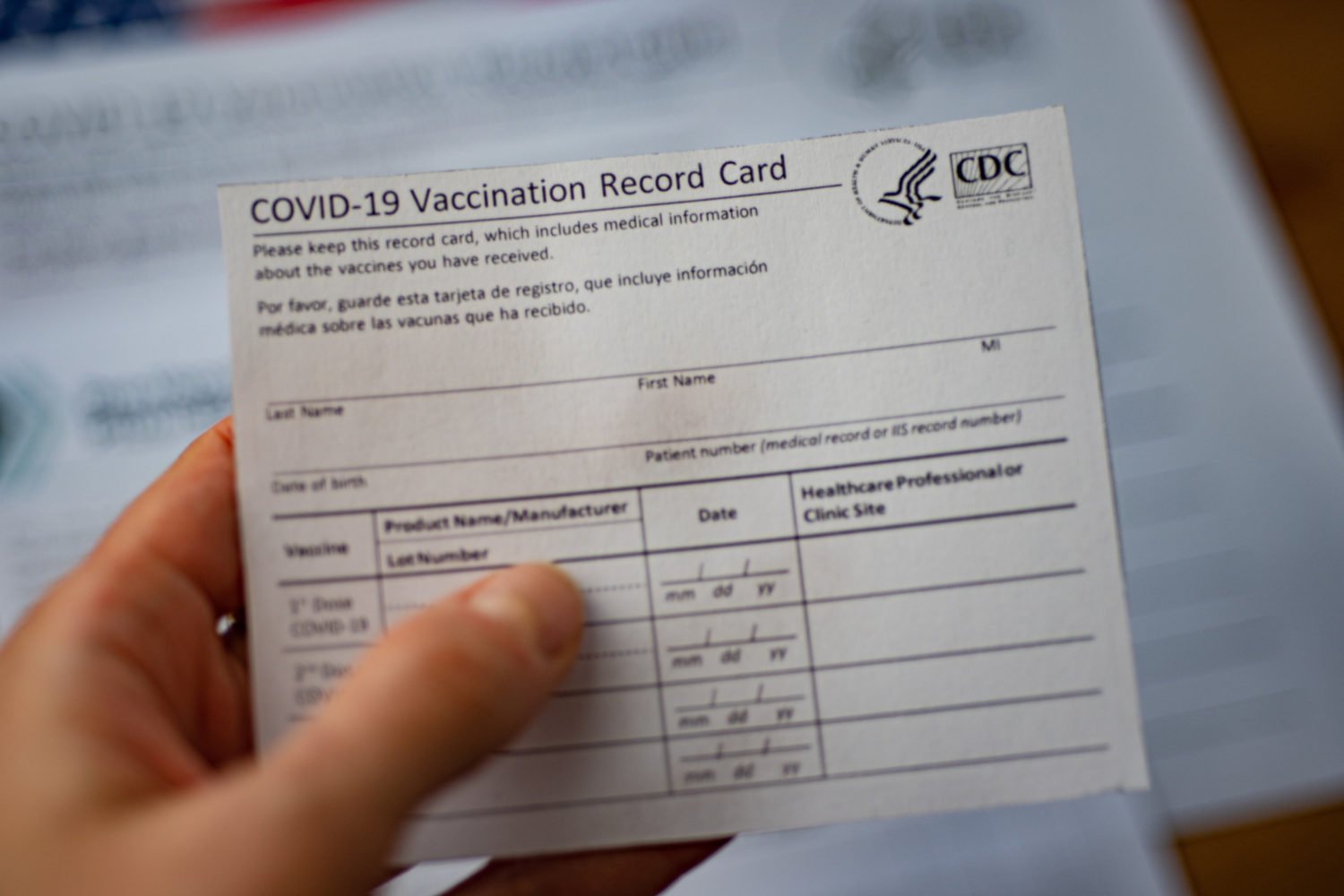

So the bill includes expansion in unemployment insurance, including an additional $600. Importantly, it includes some aid to hospitals and healthcare infrastructure. And then it also includes direct payments to individuals, so that every adult with a Social Security number will be receiving a check from the federal government. Small business owners still have some fixed costs, and so the legislation also includes loans and support for business owners, both small and large.

I was very excited about the expansion of unemployment benefits. This is our first line of support for folks who’ve lost their jobs. And I’m excited about the direct payments to individuals as well.

Here’s the thing though. I am frustrated that we weren’t able to work into the legislation a way to have a sensible off-trigger. So the unemployment benefits, it’s only for the next few months. And this crisis is not going to be over for families in June. So we need to keep these additional supports on until the economy recovers. So including both the trigger “on,” but now that we’re in the crisis, some sensible off-trigger, so that these funds keep flowing as long as we need them.

The fear is that we have a Congress lurching from one emergency package to another. President Obama’s economic advisors often described how they wanted a second stimulus package. And the lesson they learned is that the bigger the initial action, the harder it is to come back and get Congress to do something big a second time.

You’re getting at, quite frankly, the goal of the book. We wrote this before a recession started. And we said, we really need to be thinking about making sensible policies now while the sun is still shining rather than waiting for the crisis. Because this is all evidence based on things that we’ve done in prior recessions to make sure the economy is functioning.

So obviously, the sun is not shining. We’re deep in the belly of a pandemic. But I wonder if there’s a silver lining, at least for your ideas. Do you think the pandemic will boost the acceptance of some of these proposals?

One of the origins of this book was that I was at a conference of macro-economists who were talking about what we needed to do in the next recession given that interests rates are so low, and that we wouldn’t be able to use that traditional tool of monetary policy. And I was really struck by the fact that you had all these economists talking about, We need these automatic stabilizers and to make sure these systems are functioning. And yet they’re really hard to make sure they work correctly. It requires a lot of thought to make sure the UI system works, or put in place an infrastructure plan, or even to get checks out to individuals. And so we really wanted to start early on that, and help people understand what we needed to do, and how we build into the policy the science that we know works well.

And I think that’s what’s been exciting to see. Senator Bennet has worked on some legislation that is focused on triggers. You see folks on the Hill talking about triggers in new ways, and really bringing that to the forefront to the conversation. And I remain optimistic, when we start talking about the next package. What’s different between this and 2009 is that we put out a package of $2.2 trillion, and Congress is already talking about the need to do more because of the scale and scope of this unique crisis.

I wonder if the biggest dissimilarity between your proposals and this crisis—that no one could have seen it coming, despite the indicators you describe—is actually the terrifying factor that leads to wider acceptance of automatic stabilizers.

I think that every recession, we feel like, ‘Wow! If we’d only known!’ But [we can make] sure that we have systems that work, and that we are devoting our intellectual energy and the focus of our government to making sure these systems are ready when we need them.

If there’s one thing that has really come to the fore in this crisis, it’s how the underlying fragilities of our economy have been laid bare. How our lack of preparedness across our economy is amplifying both the health crisis and the economic crisis. I think of things like the millions of workers in jobs that had face-to-face contact that didn’t have paid sick days. Or the fact that prior to the start of the crisis, only a quarter of those who were out of work received unemployment insurance.

That may be the most stunning statistic of the entire book.

Many states had been cutting back on eligibility, making it harder to get unemployment insurance. The state of Florida has made it much more difficult, and now people are very frustrated. Because people are like, ‘Wow, this is a very cumbersome and difficult process.’ But people need them—to pay their rent, to pay their mortgage—and you don’t know when the next pandemic is going to come and hit. And if you have a federal government that’s incapable of responding in an adequate and timely way, you’re going to have an economic crisis like we’re in now. And you need a system that works, and you need people to be able to rely on it. What we’re trying to do in the book is help policymakers see that what they need to do is to prepare. And hopefully, they’ll listen.