This month was a busy one in the category of President Trump’s legal woes—with Michael Cohen receiving his prison sentence, AMI entering into a non-prosecution agreement, and Michael Flynn and Robert Mueller warring in dueling sentencing memos.

It was a busy month for another group, too: High-stakes players in the niche world of so-called prediction markets, a world of legal, pseudo-gambling activity that traffics in politics and world affairs as an avenue for profits. These markets pose a question online—Will Brexit commence on time? Is a government shutdown coming?—as if they were stock options, allowing gamblers (ahem, predictors) to purchase shares of a yes or no position, and thus profit on the outcome.

In these communities, nothing has proven more turbulent than the mercurial characters and plot twists of the Trump administration. And, in turn, no Trump-related market has proven more mysterious than the ongoing Mueller probe—or quite so ripe for potential windfall, at least in the feverish minds of gamblers, who take delight in summing up news cycle developments in the scabrous, cigar-flavored dialect of back-room bookmakers.

“It’s not just the American political class and media class that are obsessed with Mueller,” said Paul Krishnamurty, a professional gambler based in England, who writes for the UK gambling consortium BetFair. He has bet tens of thousands of dollars on various outcomes related to the Trump administration. “Honestly,” Krishnamurty went on, describing the Mueller developments, “you have no idea how much this stuff affects my sleep.”

Krishnamurty’s strategy, as he described it, is to buy positions on key Trump milestones—such as whether Trump will survive in office in 2019, or win the 2020 nomination—and then watch those odds depreciate as Mueller’s probe chews away at Trump’s legitimacy. “My positions, and my taxes—and I’ve written all the way throughout it—is that Mueller’s going to destroy him,” Krishnamurty told me, adding, with appropriate gambler’s bravado: “It’s a foolproof mathematical strategy!”

The concept of a Mueller-related gambling market seems just farcical enough for our present Trumpian reality. (That, and the notion that—somewhere out there in America—some poor, teeth-gnashing soul finds himself on the skids, having gotten in deep with the Mueller-gambling sharks, and dreads what the goons might do to his kneecaps.)

But Krishnamurty’s style of betting is, in fact, legally off-limits to Americans. Instead, in the United States, the epicenter for Mueller-related prediction betting is PredicIt, an online exchange headquartered in DC. There, the Mueller markets are showcased on PredictIt’s front page, where a headshot of a brooding Mueller is superimposed with the words, “Mueller to Foil Trump?”

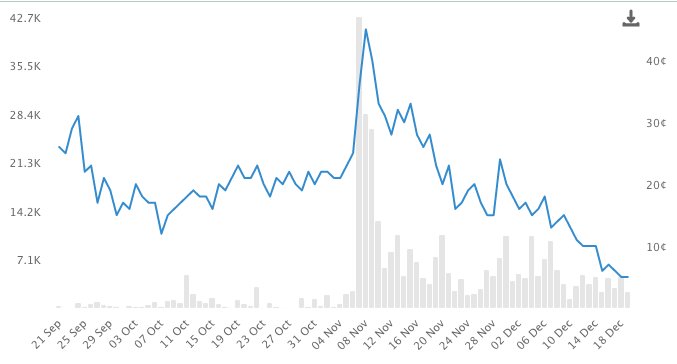

Launched in 2014, PredictIt is permitted by the Commodity Futures Trading Commission as a rare type of exchange that provides informational value to researchers and academics (about 100 of whom receive the exchange’s data about public attitudes on obscure events, according to PredictIt). And that, intriguingly, includes the ongoing Mueller probe, around which PredictIt currently showcases eleven different markets. Questions range from the odds that Trump is likely to pardon Paul Manafort (highest 90-day price: 14 cents—or 14 percent), or Michael Flynn (highest: 21 cents, or 21 percent); whether Robert Mueller will be jettisoned as Special Counsel by Trump (38 cents); and the likelihood that a rogue’s gallery of suspects in the ongoing probe, such as Roger Stone (27 cents), Jared Kushner (24 cents), or Donald Trump, Jr. (45 cents), will be charged by the Special Counsel’s office.

The appeal for traders is the mystery that shrouds the probe, says Brandi Travis, an executive with Aristotle, the company that owns and operates PredictIt. The lack of publicly available data also presents obstacles for traditional bettors. “In a typical market, you take the information you have. And if you don’t have that much information, it’s a little harder to predict,” she says. But in the case of Mueller, Travis adds, “that’s also what makes it interesting” for savvy bettors.

One is Tom Gill, a 26-year-old Philadelphia area resident who left a job on Wall Street and now makes his living trading on PredictIt full-time. “If you follow this stuff closely, you can start to put the pieces of the puzzle together,” he told me.

Gill played this year in three Mueller-related markets—whether charges will be brought against Roger Stone, Jared Kushner, and Trump, Jr.—and bought “no” positions on all of them. Those “no” contracts stand to net him a profit (roughly $3,000 total) when the deadline for those arrive on December 31. That, in some measure, can be traced to over-eager players who bought “yes” contracts earlier in the year, perhaps swayed by media reports that the Mueller probe was wrapping up soon.

“Even if you might think Trump, Jr. is going to get charged at some point—and there’s lots of speculation that he did illegal things, like lying to Congress, for example—the question is when,” said Gill. “You just don’t know when this probe is going to wrap.” Several months ago, Stone said publicly that he was prepared to be indicted; Gill swooped in and bought “no” positions, just as the “yes” shares in the Stone indictment market skyrocketed to 70 cents. Now that the market has reversed, that position alone, said Gill, is going to net him “probably $2,000.” (That’s small potatoes in Gill’s world, where a long-shot bet on Krysten Sinema in the Arizona Senate race, once it’s certified, stands to win him about $25,000.)

One PredictIt trader, Jeff Kilcorse, a research assistant at a university in Ohio, found himself on the wrong side of one of those bets: When media hype suggested Don, Jr.’s indictment was around the corner, Kilcorse bought in. “I’ll lose a couple hundred dollars on that one,” Kilcorse said wistfully.

But Kilcorse plans to earn back the difference in another lucrative arena: The Special Counsel tweet markets—which ask traders to predict how many times Trump will tweet about Mueller in a one-week period. When we spoke on the phone, Kilcorse had his eye nervously on Trump’s Twitter feed. President Bush’s funeral, he surmised, would quiet Trump for a few days. “But then I bought as soon as the market opened,” Kilcorse said, who guessed that the pent-up Trump would tweet at least eight times about Mueller that week. He bought a few hundred contracts at seven cents apiece.

When we spoke, Kilcorse was getting antsy: “He’s at four [Mueller] tweets right now,” Kilcorse said. “You know he’s going to do it. But will he mention Mueller’s name? That’s the question.”

Then there are PredictIt mavens who won’t touch the Mueller markets with a ten-foot pole. The Mueller contracts are more suited for “a casual fund, gambler, or investor,” said Joe Schuman, a government employee in Washington who majored in political science at MIT. “The other data point on the Mueller markets? These things take a lot of time,” he went on. “In some sense, it’s a traditional investment, in that you have to wait for a payout—and that you can completely flop and lose all your money.”

Like most of the PredictIt traders who spoke with Washingtonian, Schuman first took interest in the online trading community during the 2016 presidential elections, while he was still a senior at MIT. (Schuman lives in a Southeast townhouse, where his roommates—which include one prominent Hill staffer—are torn over the ethicality of betting on political events.) While PredictIt attracts plenty among the casual and curious types, serious bettors described a data-gathering regimen for their trading positions that would make a liberal arts major blush. Schuman, for instance, has built a computer model for predicting Trump’s Twitter behavior, into which he feeds new data each week, so that he can outperform the PredictIt markets. “My perspective is, you can only beat the market if you have more information,” says Schuman. “And the stuff about Mueller—you almost have to be on all day, just watching the news.”

In that spirit, the purpose of PredictIt—legally speaking, at least—is to provide enlightenment on current affairs that traditional polls might miss. And occasionally, the Mueller markets do provide this kind of insight.

Take, for instance, Gill’s position on the so-called “sworn testimony” market: That Trump will provide sworn testimony to Mueller by December 31, and—crucially—that the White House or Special Counsel’s office will confirm it by that date. In November, Trump’s lawyers confirmed that Trump submitted written answers to Mueller’s questions. But with just two weeks to go until closing, the PredictIt market on the question is trading at 80 cents for “no.” What gives?

The reason, says Gill, is because neither the White House nor the Special Counsel’s office has officially confirmed, in public or written statements, that Trump’s handwritten submissions were, in fact, sworn statements—and confirmation is part of the rules. Gill arbitraged, initially buying “yes” shares back when Trump’s pugnacious talk of flouting the Special Counsel’s questions had sent those shares plummeting to 15 cents. “Once [Trump] submitted the answers, I sold all the “yes” shares I’d been buying at 15 cents at 70 or 80—then turned around and went to the other side.” (He expects to win about $3,000.)

That series of events—loopy as it sounds—highlights the Wild West volatility of this market. “It’s not impossible that Trump, even today, gets asked the question, and responds, ‘Yes, they were under oath,’ ” Gill pointed out, which would send the market into an instant reversal, thus wiping away Gill’s position.

Now traders are turning their attention to 2019, where the drama of political affairs (and the potential markets waiting to capitalize on them) seems boundless—with developments from Mueller waiting in the offings, and amplified by Democratic House committees which could summon characters like Michael Cohen to testify publicly, revealing yet new information about the ongoing probe.

One possible hot market: Whether a pardon lies in store for Paul Manafort in 2019. That question has “yes” shares trading around 26 cents. Gill is eyeing that market, too—but hasn’t entered yet. “I think the ‘yes’ shares are too high,” he says. “To actually pardon Paul Manafort would seem like a stretch. But he might.”

“There’s a lot of opaqueness to the markets for sure. But that’s why it’s a game of predicting,” Gill went on. His advice to anyone joining the Mueller game, he cautioned, is simple:

“Be extremely wary.”