A wide range of extra fees have flooded the DC dining scene over the past year, creating confusion and frustration among diners. Among the biggest issues: where exactly is this money going and how much, if anything, should customers tip? Today, DC’s Office of the Attorney General issued more guidance to businesses about fee transparency, offering examples of what—and what isn’t— compliant with the law.

Service fees have become ubiquitous in the wake of Initiative 82—the ballot measure DC voters passed last fall to eliminate the “tip credit” that allows businesses to use gratuities toward workers’ base wages. The new law, which will phase out the tipped minimum wage over the next few years, means that local restaurants are moving from paying servers, bartenders, and other tipped workers at least $5.35 an hour to a universal minimum wage of at least $17. To make up for those labor costs, many restaurants have introduced mandatory service fees. At the same time, many businesses have tacked on a range of other fees related to inflation, Covid recovery, and more. It’s the wild west of extra charges, which can range from three to 22 percent and often come with vague disclosures.

DC attorney general Brian Schwalb put out a consumer alert in March about deceptive restaurant fees following an influx of complaints from customers. The big message: The type of fee and its amount must be “clearly and prominently” disclosed before customers place their orders, and restaurants must accurately describe what the fee is for. (No ambiguous terms like “restaurant recovery” fee without explaining what specifically what it will help recover.)

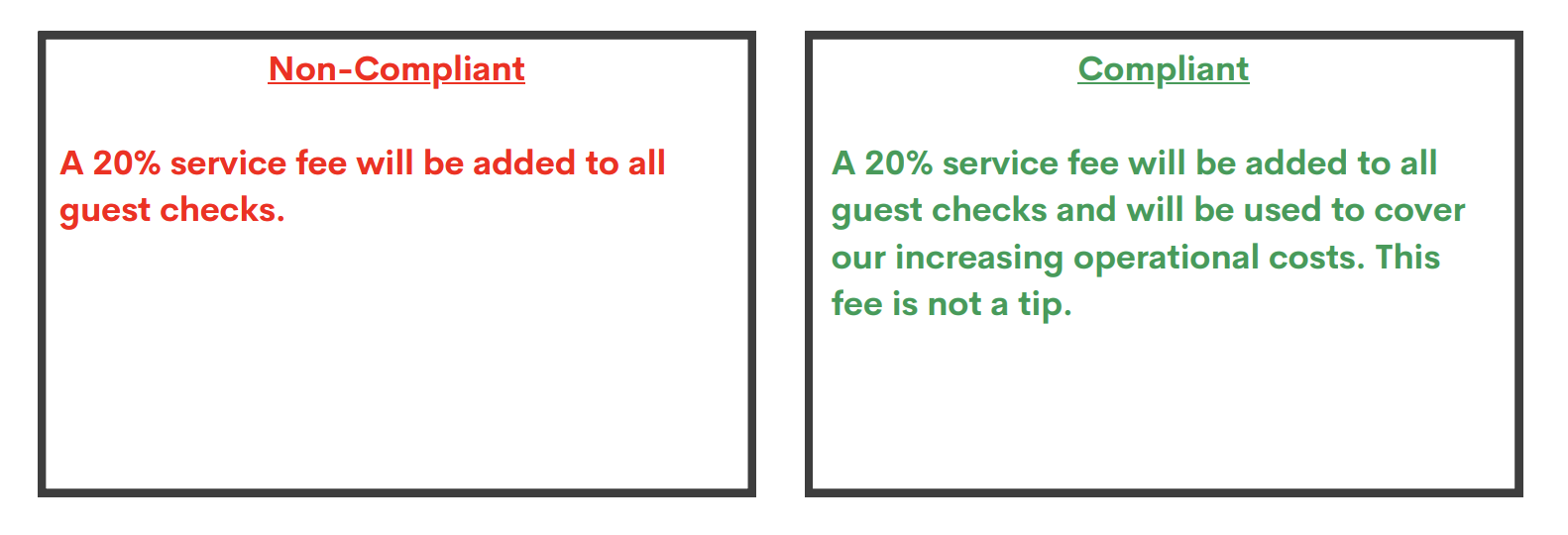

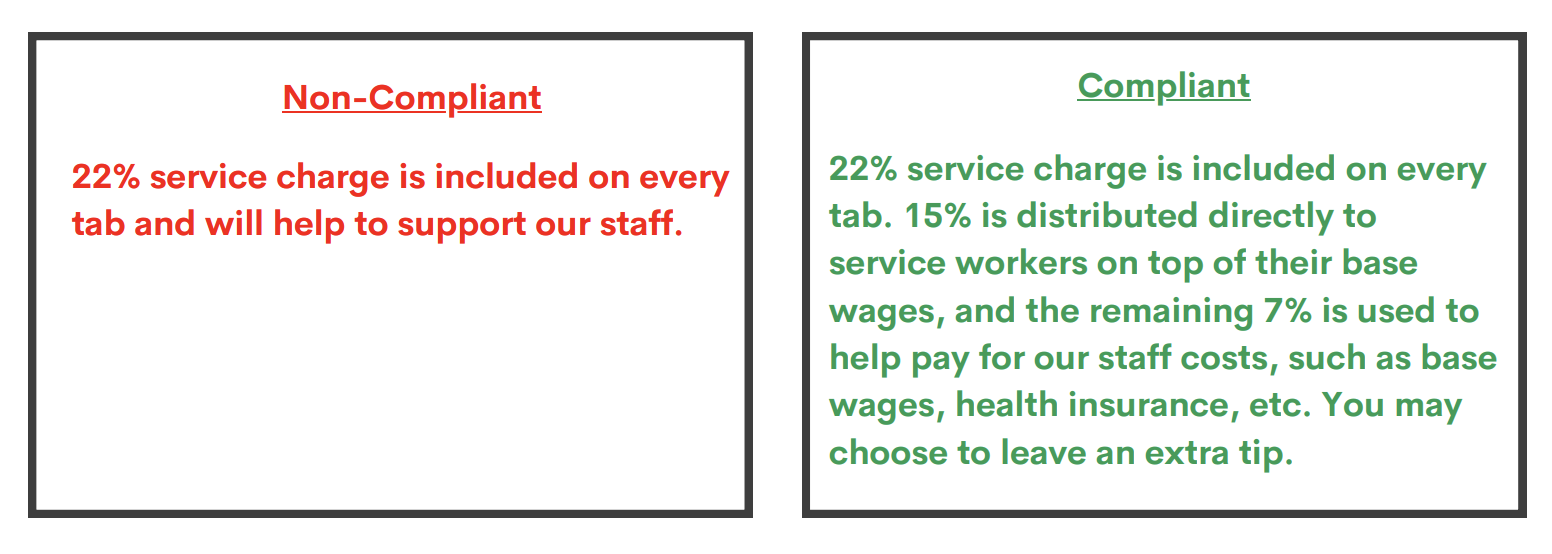

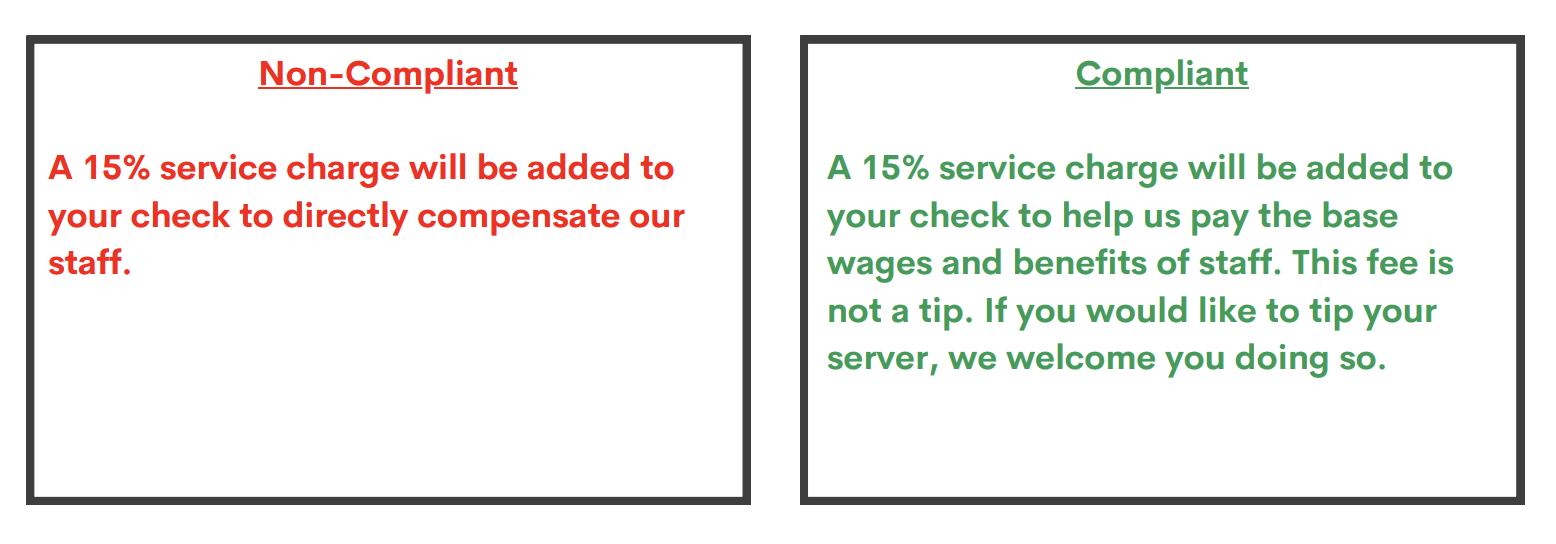

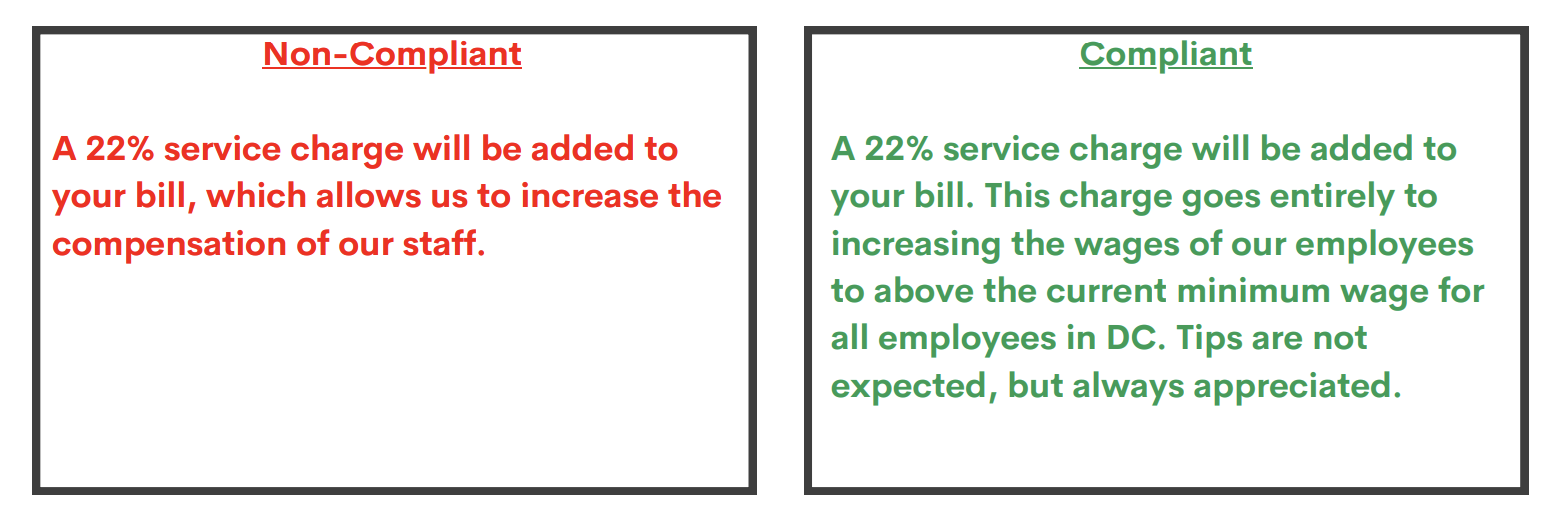

The latest “supplemental business advisory,” developed with input from “industry stakeholders” like the Restaurant Association Metropolitan Washington, gets a little more specific. Notably, it’s not enough for restaurants to say that a service fee helps to “support our staff” or “directly compensate our staff.” They must make clear if the money goes toward base wages and benefits or is distributed on top of base wages, like a tip.

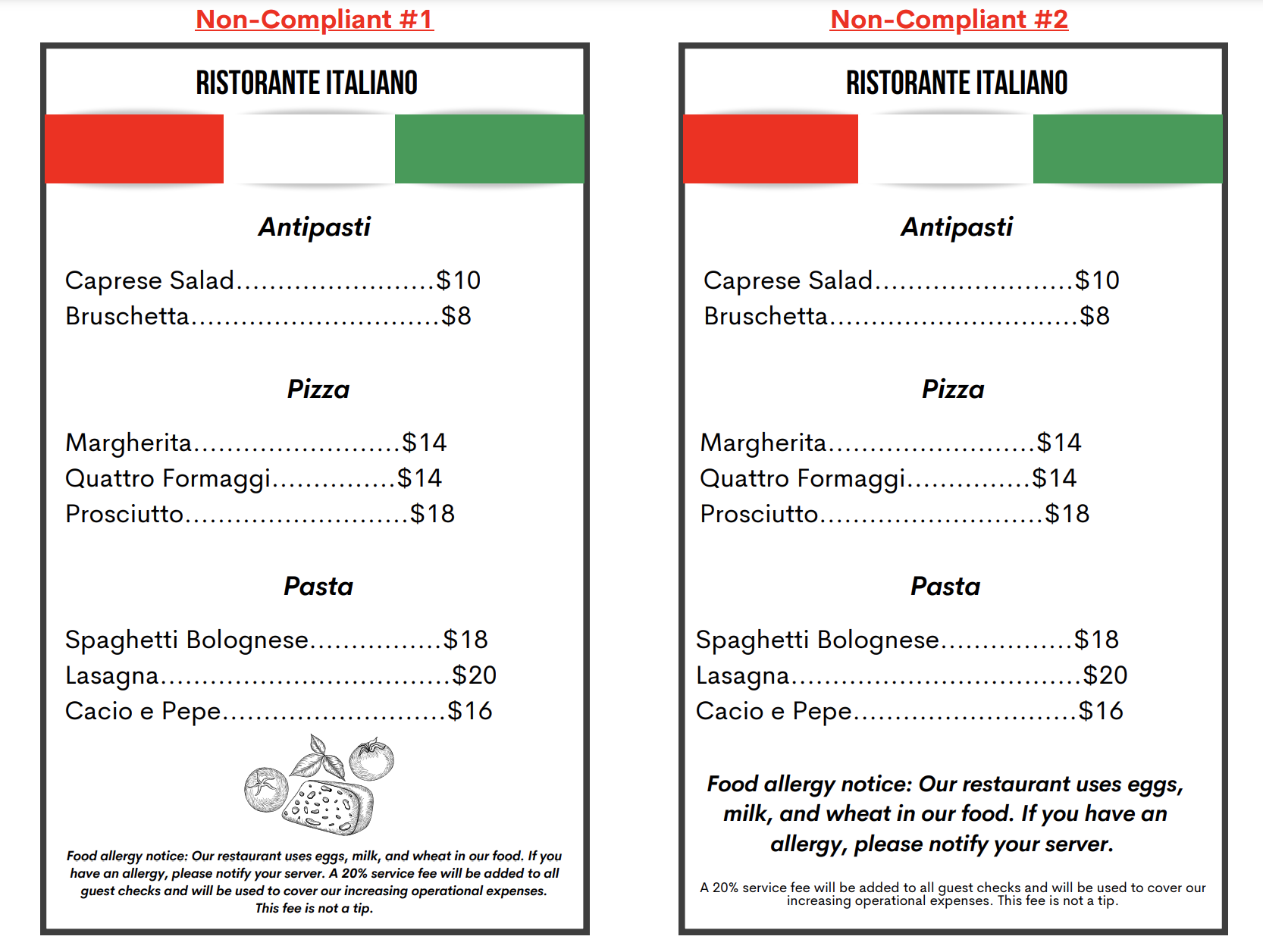

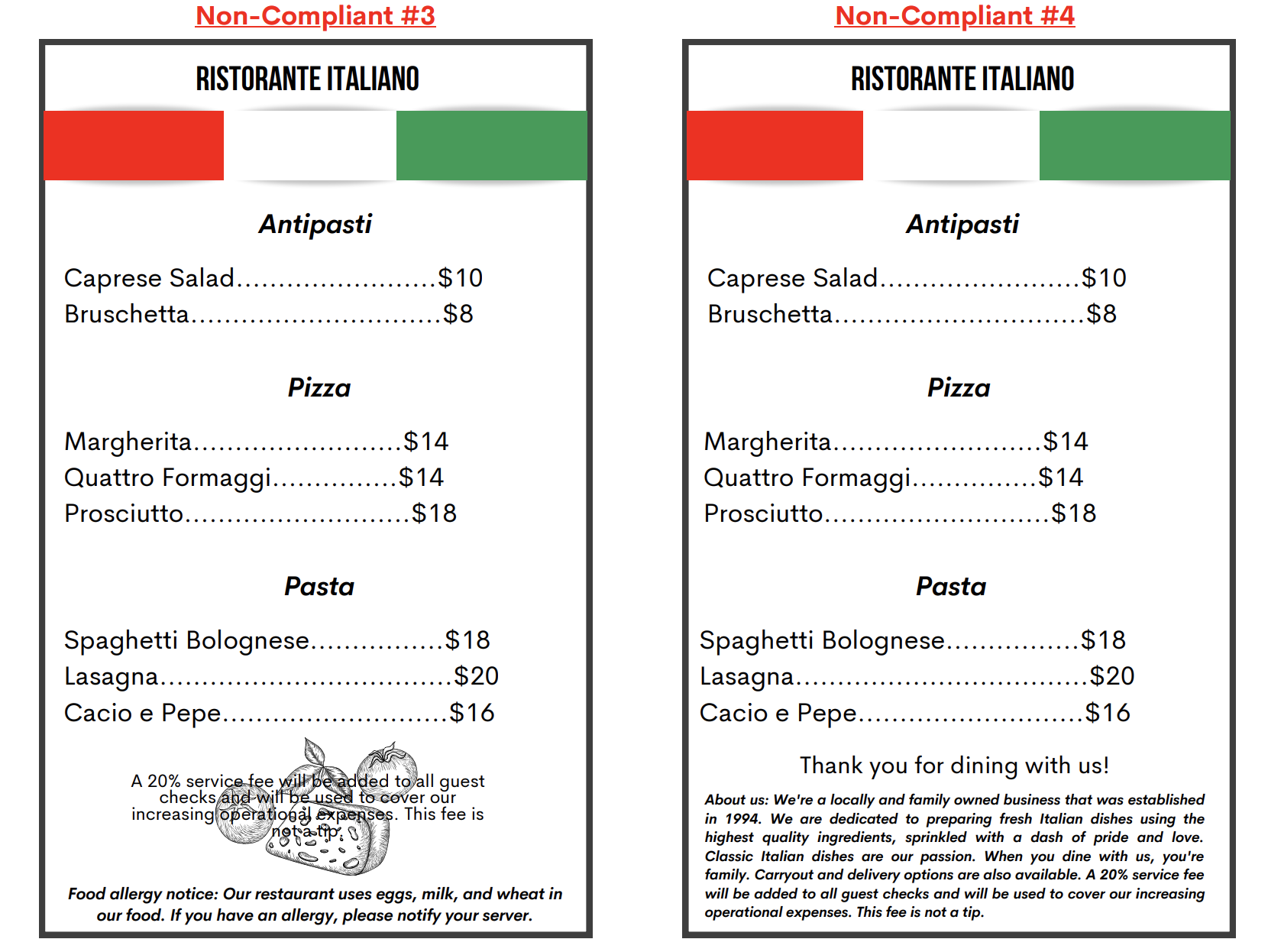

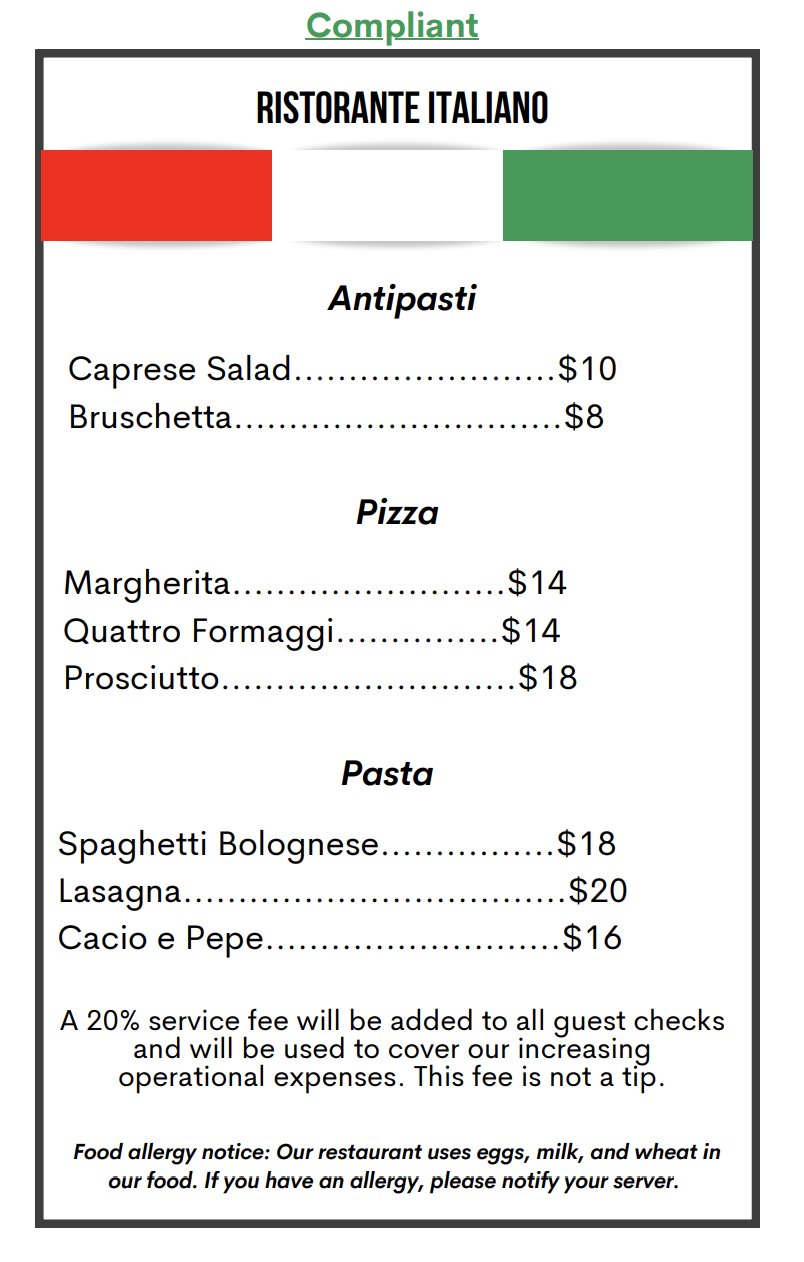

The new guidance also requires fees to be displayed more prominently on menus: “A good rule of thumb for restaurants is to communicate service fee information in the same manner that they communicate their prices.” Fees should not be buried, in fine-print, or combined with unrelated information like food allergy notices. Rather, the fees should be as obvious as, say, the $10 price tag on the caprese salad. Fees can also be communicated verbally on signs, so long as diners are likely to be aware of them.

While restaurants violating DC’s consumer protection laws may first receive warnings, the Office of the Attorney General may seek refunds for consumers, issue penalties, and force businesses to change their practices.

Below are some examples of what kind of fee disclosures are allowed, although the Office of the Attorney General notes that compliance with the law will be determined on a case-by-case basis. Read the full document with more details about each example here.