On October 22, 2012, Sibley Memorial Hospital applied to build

a four-room proton-therapy cancer facility on its campus in upper

Northwest DC. Two days later, Georgetown University Hospital applied to

build a smaller proton-therapy unit at its Lombardi Comprehensive Cancer

Center.

On the surface, the applications are a seemingly routine part of

hospital expansions—but they touched off a rare public skirmish in the

quiet technology arms race across the Washington health-care industry.

For patients, the arrival in Washington of proton therapy—an innovative

radiation procedure that relies on a concentrated beam of particles that

can spare surrounding healthy tissue—would be an exciting development. The

still unproven technology, which is 20 to 30 times more expensive than

existing therapies, holds great promise for treating tumors in children

and growths in the brain or near the spinal cord in adults.

With cancer rates in the District among the highest in the

nation—the disease is the number-one cause of premature death in the

capital, higher than heart disease and HIV/AIDS—the possibility of having

two new facilities in the area offering cutting-edge cancer treatment for

the first time shows all signs of being a major advance welcomed by the

health-care community.

Except that precisely because the therapy is so expensive, it

also has great business potential for both hospitals—Sibley predicts it

would generate 80 percent of its profits within six years. With that

incentive, the applications turned into a duel between two of the region’s

dominant hospital systems: MedStar Health—which owns Georgetown University

Hospital—tried to kill the application by Sibley; in response, Sibley

suggested MedStar’s methods might have been “fraudulent.” Johns Hopkins

has been expanding south from its Baltimore home and had recently merged

with Sibley, the small but profitable hospital in DC’s Spring Valley.

MedStar saw a threat to its command of Washington’s cancer-treatment

market.

“We’re all doing a lot of the same things,” says Barry Wolfman,

CEO of George Washington University Hospital, who watched from the

sidelines. “You don’t want someone on your turf.”

“It happens very rarely for hospitals to openly oppose one

another,” says Amha Selassie, director of DC’s State Health Planning and

Development Agency, which considered the two applications. He’s been at

the agency since 1985. “This was about a new player coming to town. The

environment is changing.”

The public conflict provides a glimpse into the fierce

competition for new technology, patients, and revenue that hospitals in

the Washington area are facing in the era of consolidation and health-care

reform.

“This is more than a fight over machines,” says David Catania,

the DC Council member responsible for overhauling the city’s health-care

system in the past decade. “This is about market share and

survival.”

Although Washington has long had distinguished hospitals and

doctors, without a star facility such as the Cleveland Clinic or the Mayo

Clinic, it has never been known as a destination for medical expertise.

But in recent years, the area’s health-care reputation has been on the

rise.

“DC is emerging from the sleepy Southern town it was in the

1990s in many ways,” Catania says. “That’s true for health care, too. I

see no reason why we can’t create an environment where we bring the best

players in the world here and let them compete for the best services at

the best prices.”

Washington already has many of the building blocks to become a

destination for those in need of high-quality health care. The suburbs are

wealthy and growing, providing patients who need and can pay for care. In

the District, 92 percent of residents are covered by private or public

health insurance, making it a potentially lucrative market.

To meet the demand, hospital systems across the region are

pouring millions into rebuilding and adding new facilities, especially

outpatient services.

Bethesda’s National Institutes of Health, with its

multibillion-dollar research budget, is willing to form alliances; there’s

an NIH stroke center at Washington Hospital Center and an NIH

cardiac-surgery center at Suburban. And Children’s National Health System,

ranked among the country’s best pediatric hospitals, is partnering with

NIH on research into pediatric heart disease. All the babies in NIH

programs that have genetic diseases are being cared for at

Children’s.

“We are creating a branch of NIH here in our hospital,” says

Kurt Newman, president and CEO of Children’s. “We have patients and

doctors. They have the science. Only in Washington can you do these

things.”

• • •

All of these projects and new technologies cost money, and the

business models to provide care are under assault. “If you are not

affiliated with someone or part of a larger group, you get run over,” says

Julius Hobson Jr., a senior policy adviser specializing in health care

with the Polsinelli law firm. “You simply cannot make it as a freestanding

hospital. You can’t achieve the economies of scale.”

From a hospital’s standpoint, the advantages of consolidation

are many—from buying supplies in bulk to contracting with groups of

doctors who bring patients to building outpatient facilities to providing

health-care insurance along with the services. The goal is to keep

patients—and the revenues from their care—within the “megasystem” from

cradle to grave.

Thanks to a wave of mergers in the 1990s, almost every

independent community hospital in the area has joined a larger health-care

system. In 1997, George Washington University Hospital became part of

Universal Health Services, an investor-owned management company in

Pennsylvania; Holy Cross Hospital in Silver Spring joined with Trinity

Health, a Catholic health system in Michigan. Dimensions Healthcare owns

Prince George’s Hospital Center and three other hospitals in the

county.

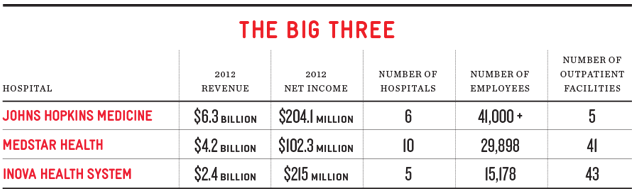

But by far the most dominant players in the Washington

health-care market are three nonprofit megasystems: MedStar Health, Inova

Health System, and Johns Hopkins Medicine.

MedStar, the region’s largest health system, owns seven

hospitals in Maryland and three in DC, including Georgetown, Washington

Hospital Center, and National Rehabilitation Network. It also operates a

variety of medical businesses, outpatient facilities, and its own

insurance plan. It reported revenue of $4.2 billion in 2012.

Inova Health System has dominion over Northern Virginia with

five hospitals—including its flagship in Fairfax, ranked by U.S. News

& World Report as the top hospital in Washington. Inova reported $2.4

billion in revenue for 2012 and cleared $215 million. Inova has 95

“centers of care,” president and chief operating officer Mark Stauder

says, including those for urgent care, surgery, and other outpatient

facilities. The nonprofit firm also owns a Medicaid managed-care company

and a health-insurance company in a joint venture with Aetna.

Johns Hopkins Medicine owns the top-rated, flagship health

center and medical school in Baltimore plus five academic and community

hospitals and four suburban health-care and surgery centers, primarily in

Maryland. Its Hopkins Community Physicians includes 37 community

health-care providers. A latecomer to Washington, Hopkins merged with

Bethesda’s Suburban Hospital in 2009 and with Sibley 18 months later. It

reported revenue of $6.3 billion, with a net income of $204.1 million, in

2012.

These revenues seem large, but you can’t evaluate hospitals as

if they’re car dealerships. Their mission of keeping people healthy and

working in the communities they serve adds an altruistic element. Most of

the area’s acute-care hospitals are nonprofit and operate on small

margins. They must return extra revenue to the community in the form of

free care, education, or research. Inova, for example, says it delivered

3,000 babies at no charge last year. MedStar says it provides more than

$300 million in free care and education annually.

“We take care of people who show up at our door, whether they

can pay or not,” says John Sullivan, president of MedStar’s Washington

Hospital Center. But at the end of the day, hospitals need to break even,

at the least.

“Money is the blood of hospitals,” says Robert Malson, longtime

head of the District of Columbia Hospital Association. “No money, no

mission.”

The mission of keeping hospitals alive now includes competition

to attract and keep patients, the need to advertise services, the ability

to lure great doctors, the expansion into health insurance, and the race

for the latest technology. What’s more, the Affordable Care Act—commonly

known as Obamacare—has created a “new order,” according to Inova president

Mark Stauder. Hospitals and health-care systems will no longer be

compensated on the “fee for services” model, based on the volume of

patients and the number of treatments they perform. They’ll be paid and

judged on quality of care, measured by how efficiently they treat patients

and keep them well and out of the hospital.

“The business of health care will be megasystems competing

against one another,” says Paul Lee, founder of Strategic Health Care, a

consulting firm in the District. “It’s happening across the country. DC is

no different.”

Johns Hopkins brought Sibley into its system in November 2010

as a wholly owned subsidiary. “There’s only so much Hopkins could do in

the Baltimore market,” David Catania says. “It is a great brand, but it

had to expand. It had to come where the money is.”

Sibley is located in one of the city’s most elite neighborhoods

and serves many wealthy patients who come with private insurance. It sits

on acres of valuable property for expansion. It offers strong specialty

services in cancer treatment, obstetrics, and orthopedics. Hopkins also

benefits from Sibley’s foundation and its endowment of $44

million.

In June, Hopkins broke ground on the “new Sibley.” The

$243-million project will add a new emergency department, a new cancer

center, and 18 labor and delivery suites. Its centerpiece will be 200

private patient rooms that fit the profile of luxury suites.

Sibley’s hardly alone: Many hospitals in the area and across

the country have added luxury suites to attract high-end patients and the

revenue they bring. MedStar’s Washington Hospital Center has a VIP wing

with soundproof suites, private chefs, china and crystal table settings,

and sofa-beds for family members.

Likewise, Sibley’s application to build a massive

proton-therapy facility was a move to muscle into the potentially

lucrative cancer-treatment market. It proposed four so-called vaults at a

cost of $129 million. As of this past spring, there were only 11 working

proton treatment centers in the US—though 17 were under construction,

including one near Baltimore.

In its application to DC’s State Health Planning and

Development Agency (SHPDA), which must approve any hospital expansion,

Sibley projected hefty revenues from the proton-therapy facility,

scheduled to open in 2017. If approved, it would generate a $9.3-million

profit by 2018. The next year, Sibley expects it to generate $15 million

in profits; that would represent nearly 80 percent of its anticipated

profit of $21 million.

MedStar saw Sibley’s potential profits cutting into its

cancer-treatment market.

• • •

In 2000, Georgetown University Hospital was “going broke,

essentially,” says president Richard Goldberg, who’s been with the

hospital 45 years. MedStar bought the hospital and invested millions in

the facility, doctors and nurses, and specialties such as gastroenterology

and neurosurgery. “We’ve gone from deficits to a healthy surplus,”

Goldberg says. “It’s been a tremendous advantage.”

MedStar, headquartered in Columbia, is the largest nonprofit

health-care system in the Mid-Atlantic. It controls hospitals and

outpatient facilities stretching into southern Maryland—and it’s been

known to protect its market share aggressively.

In 2012, George Washington University Hospital applied for a

certificate of need to reestablish its kidney-and-pancreas transplant

program. MedStar controlled the market and opposed GW before the State

Health Planning and Development Agency, arguing that its monopoly served

the public interest because it controlled costs and produced successful

outcomes. The problem, MedStar maintained, was the lack of organs rather

than operating rooms.

The agency denied GW’s request and preserved MedStar’s

monopoly. MedStar hoped for the same outcome when it challenged Sibley’s

proton-therapy project.

• • •

MedStar first publicly signaled its opposition to Sibley’s

proton project at a public hearing on January 8 of this year. Regina Knox

Woods, head of MedStar’s government affairs in DC, suggested that the

health-care planning agency make its decision “not based on the interests

of a particular business wanting to increase market share” but rather the

needs of District residents. The “business” was Hopkins.

For the next five months, as SHPDA weighed testimony and

assessed documents, MedStar attacked Sibley in public and private. In

written responses to hearing testimony, it called Sibley’s proposal

“operationally and financially infeasible,” questioning the “true

ownership structure” of the proton-therapy center and challenging Sibley’s

commitment to working with underserved communities in need of cancer

treatment.

To blunt the criticism, Sibley had approached Howard University

Hospital and United Medical Center in the District’s Ward 8 to collaborate

in cancer care, screening, and research—and, when necessary, to bus

patients to Sibley for treatment. Top officials from both Howard and UMC

extolled the collaboration before a DC Council committee.

But in written responses, MedStar derided Sibley’s

“collaborations” and called them “much ado about nothing.” In one

broadside, it referred to Sibley’s partnerships as “a cynical strategy

belied by the facts” and its track record in working with DC’s poor as

“woeful.”

The conflict took on a personal tone at least once. A number of

council members sent letters of support to SHPDA for proton projects by

both Sibley and MedStar. But when the Federal City Council sent a similar

letter of dual support, MedStar CEO Ken Samet took Federal City Council

executive director Anthony Williams and chairman Robert Flanagan aside to

register his displeasure at their support for Sibley and Hopkins,

according to sources.

Sibley blasted back, accusing MedStar of inventing facts “to

deceive and misinform” and of “manic manipulations of data.” In a February

8 response, Sibley called MedStar’s attacks “a blatant attempt to engage

in anti-competitive behavior and deprive Washington, D.C., of a valuable

competitor.”

In its filing, MedStar suggested that Sibley had created a

“phantom” entity to finance its proton project. Sibley countered with a

detailed description of its funding sources. It accused MedStar of “lack

of integrity” and said “the perversion of facts is so pervasive that it

raises the question of whether [MedStar Georgetown University Hospital’s]

petition reveals fraudulent purposes.”

MedStar and Sibley traded accusations and charges into the

spring.

“What is good business for Johns Hopkins is not necessarily

good or wise health care for the DC metropolitan region’s residents,”

MedStar wrote on March 8.

Sibley countered on April 16: “MedStar’s opposition to Sibley’s

[certificate of need] remains grounded in fear of competition if world

class health care services are available in the District.”

• • •

On May 31, SHPDA approved Georgetown’s proton-therapy facility

and granted a certificate of need to two of Sibley’s four proposed

proton-therapy vaults. Its lengthy report discounted MedStar’s attacks and

concluded: “Although it can be argued that as a free standing community

hospital, Sibley would not have had the infrastructure to establish proton

therapy, with the involvement and commitment of Johns Hopkins, the

proposed project is a viable program.”

When I ask Georgetown Hospital president Richard Goldberg about

MedStar’s opposition to Sibley’s proton project, he downplays the

conflict, calling the SHPDA review “a great forum for healthy

discussion.”

Does MedStar fear Hopkins’s arrival on the local market? “No,”

says M. Joy Drass, executive vice president for MedStar’s operations in

the Washington region. “They are a nationally recognized health-care

provider. We will make each other better.”

Both Sibley and Hopkins declined to discuss the proton

project.

Meanwhile, Children’s National Health System has agreed to

collaborate with Sibley to establish a pediatric cancer-treatment program.

SHPDA had turned down one of Sibley’s four proposed proton vaults because

the hospital lacked a pediatric program. With Children’s on its team, it

has reapplied for the third proton-therapy room.

• • •

Given the current round of consolidation and competition, can

Washingtonians expect better health care? “People benefit from more

competition, not less,” the DC Council’s David Catania says. “I want

health-care providers competing to serve our residents. The benefits are

just starting.”

Where it makes financial sense, we’re also likely to see more

collaborations such as the one between Children’s and Sibley. This fall,

Children’s and Inova are opening a joint facility called Pediatric

Specialists of Virginia, in Fairfax and Falls Church.

“We were looking at expanding our pediatric care to compete

with Inova,” Children’s CEO Kurt Newman says. “Maybe we should take a

different approach, we thought, from competition and an arms race to try

and out-do Inova. Why not cooperate?”

MedStar’s Washington Hospital Center took a similar tack when

it formed an alliance with the Cleveland Clinic, which has one of the

nation’s best cardiac programs. The two will collaborate to share patients

and bring the latest medical innovations to market.

“The business model for Cleveland Clinic is they will offload

volume,” Washington Hospital Center president John Sullivan says. “We will

end up with better outcomes and patient flow.”

One benefit you’re not likely to see is long hospital stays.

“You’re always going to need hospitals,” says Rob Hartmann, head of

marketing for National Rehabilitation Network. “But we have to reduce

health-care expenses and costs. That means moving everything out of the

hospital that’s not essential to that environment.”

Industry leaders predict that’s the model we’re heading toward.

“The hospital is the hub with spokes into the community,” says George

Washington University Hospital CEO Barry Wolfman.

Regardless of whether they offer care in hospitals, outpatient

centers, or doctors’ offices, health-care providers will have to compete

for patients and their loyalty—which likely means better services, better

facilities, better technology.

Strategic Health Care’s Paul Lee sees access to data tipping

power toward the patient, too: “The government is demanding that

health-care providers make more information available to consumers. For

the first time, patients are able to compare hospitals and nursing homes

and make decisions based on quality.”

In a few years, they can compare Sibley and Georgetown for the

best proton-therapy facilities.

This article appears in the October 2013 issue of The Washingtonian.