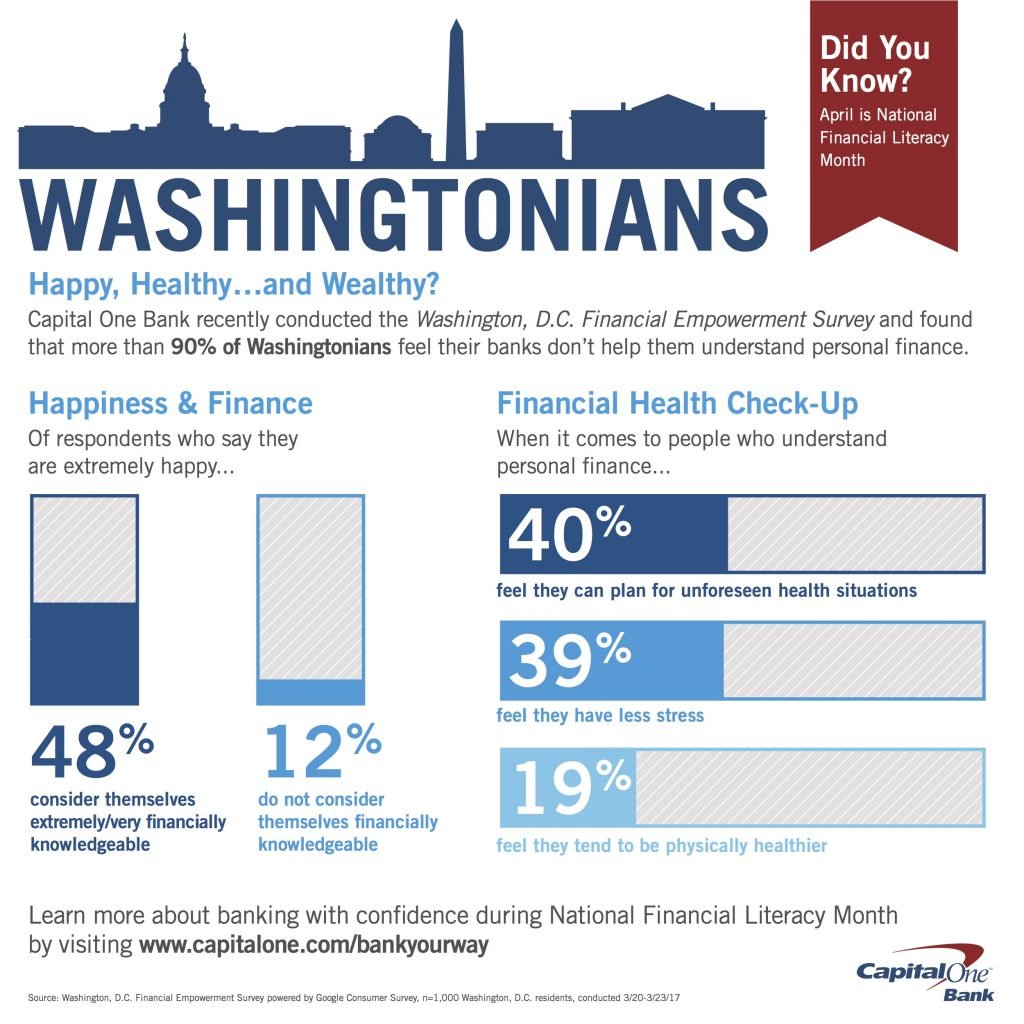

April is National Financial Literacy Month, and Capital One Bank is rolling out resources to empower consumers to bank with confidence. According to its recent Washington, D.C. Financial Empowerment Survey, more than 40% of Washingtonians believe that confidence in financial matters contributes to overall success and well-being, though only 10% of respondents consider themselves ‘extremely financially knowledgeable. Whether or not you feel confident in your finances, it’s a great time to brush up on your knowledge. Start by following these five healthy habits to begin living a more prosperous financial life.

1. Regularly contribute to an emergency fund

Most financial experts agree that you should have an emergency savings fund that holds about three to six months’ worth of expenses, just in case. While this sounds daunting, if you get into the habit of putting a little bit away once a month or every time you get paid, actually saving this amount seems a bit more achievable. While regularly contributing money to an emergency fund isn’t as fun as spending your extra cash on new clothes or a vacation, it’s worth the peace of mind: if your car breaks down, you lose your job, or find yourself facing unexpected medical bills, you’ll be covered.

2. Deposit checks via your smartphone

A trip to the bank just to deposit a check is a thing of the past. As long as you have the latest version of the Capital One mobile banking app, you can use Mobile Deposit to snap a photo of the front and back of your check, and you’re done. The best part? As long as the check is received before 9pm EST on any given business day, it will post the same day!

3. Hire a digital personal assistant

Taking advantage of new technology like Eno from Capital One will save you time every day. As your own personal assistant, Eno can help manage your Capital One accounts by leveraging artificial intelligence to understand what you need. You can use your cell phone to text or message things like, “What’s my balance” or “How much credit do I have?” and it will respond with the information you asked for right away. You can also pay your credit card bill simply by writing “Eno, pay my bill.” Eno even understands emojis – sending the money bag will prompt a return message with your current account balance!

4. Develop a strategy for avoiding impulse purchases

A 2016 study from CreditCards.com found that five out of six Americans admit to impulse buying, with one of the six spending more than $1,000 on their unplanned purchase. If you’re susceptible to this kind of spending, come up with a plan to avoid it. Some experts recommend following the 15-minute rule, where you take a walk around the block or visit another website for 15 minutes. Chances are, the urge to make the purchase will have subsided. Forbes suggests comparing the cost of the item with the time it would take you to earn that money. Sure, they’re great shoes, but are they worth a full day of work? If self-discipline won’t cut it, Learnvest suggests more tangible measures like leaving your credit card at home, calling a friend or relative after a bad day instead of taking that trip to the mall, unsubscribing from those tempting mailing lists, and even avoiding shopping trips with friends who tend to overspend.

5. Understand (and keep track) of your credit

Your credit score plays an essential role in your financial journey and is an important number to know. Credit can impact your ability to get a loan for large purchases like a house or car, your insurance premiums on that house or car, and even things like where you live and work (employers and landlords both frequently run credit checks). With an app like CreditWise® from Capital One, it’s free to both check your score and access your credit report, whether or not you’re a Capital One customer.

To learn more about the state of Washingtonians’ finances this National Financial Literacy Month, Capital One asked locals some questions as a part of their Washington, D.C. Financial Empowerment Survey. Check out some of the top results below and visit their website here to learn more.