Tax season is upon us, and this year expanded credits may help lower your bill—if you know what they are and how to get them. We spoke to local tax experts about three potential opportunities.

Clean Vehicle Credit

People who bought a new electric vehicle on or after January 1, 2023, could be eligible for up to $7,500 in tax credit. Qualifying cars purchased from that date through April 17, 2023, start with a baseline $2,500 credit, which is increased up to $7,500 if the car meets battery requirements. If you bought a vehicle from April 18, 2023, onward, it must hit two key criteria to receive the credit: Filers get $3,750 for meeting a certain battery requirement, and the other $3,750 is credited if you reach a critical-minerals requirement. In order for the filer to clinch the benefit, both dealer and buyer need to report the vehicle information. “The dealer needs to give you, the vehicle holder, the information about it when it’s purchased, so that’s a little different than the past,” says Fred Fanucci, a partner at Citrin Cooperman in Bethesda. “They’re also required to report that to the IRS. If the dealer doesn’t do their part, you may not be able to qualify for the credit.” The credit is phased out at different incomes: $300,000 for married couples filing jointly, $225,000 for heads of households, and $150,000 for everyone else.

Energy Efficient Home Improvement Credit

If you gave your residence a green makeover in 2023, you could qualify for a tax credit of as much as $3,200 on the upgrade, thanks to the Inflation Reduction Act. The credit covers up to 30 percent of qualified expenses dedicated to home-energy updates, and it restarts each year thereafter (through 2032). Improvements include new windows and doors, heat-pump installations, and home-energy audits, each with its own credit cap. Similar to the EV credit, you also need to prove that upgrades meet the requirements. “It’s important to have receipts and documentation that you are installing the energy-improved equipment,” says Fanucci. “The people who are installing and doing that should know whether those standards are met or not.” There are no income minimums or maximums for this credit.

Child Tax Credit

While right now the Child Tax Credit re-mains the same as last year, tax pros recommend keeping an eye on legislation that could impact the credit after the April filing deadline. An expanded version of the credit passed through the House of Representatives in January, with changes that would mainly affect lower-income families who don’t currently qualify. A provision increases the refundable portion of the additional child tax credit (now capped at $1,600 per child) to $1,800 per child in 2023, $1,900 per child in 2024, and $2,000 per child in 2025, adjusting for inflation. The legislation is currently with the Senate, but don’t worry if you file taxes before a bill goes through, says Andrew Lampropoulos, a CPA at YHB in Falls Church: “The IRS would go back and give you credit for that. It wouldn’t have to be an amended return or anything—that’s something they would do.”

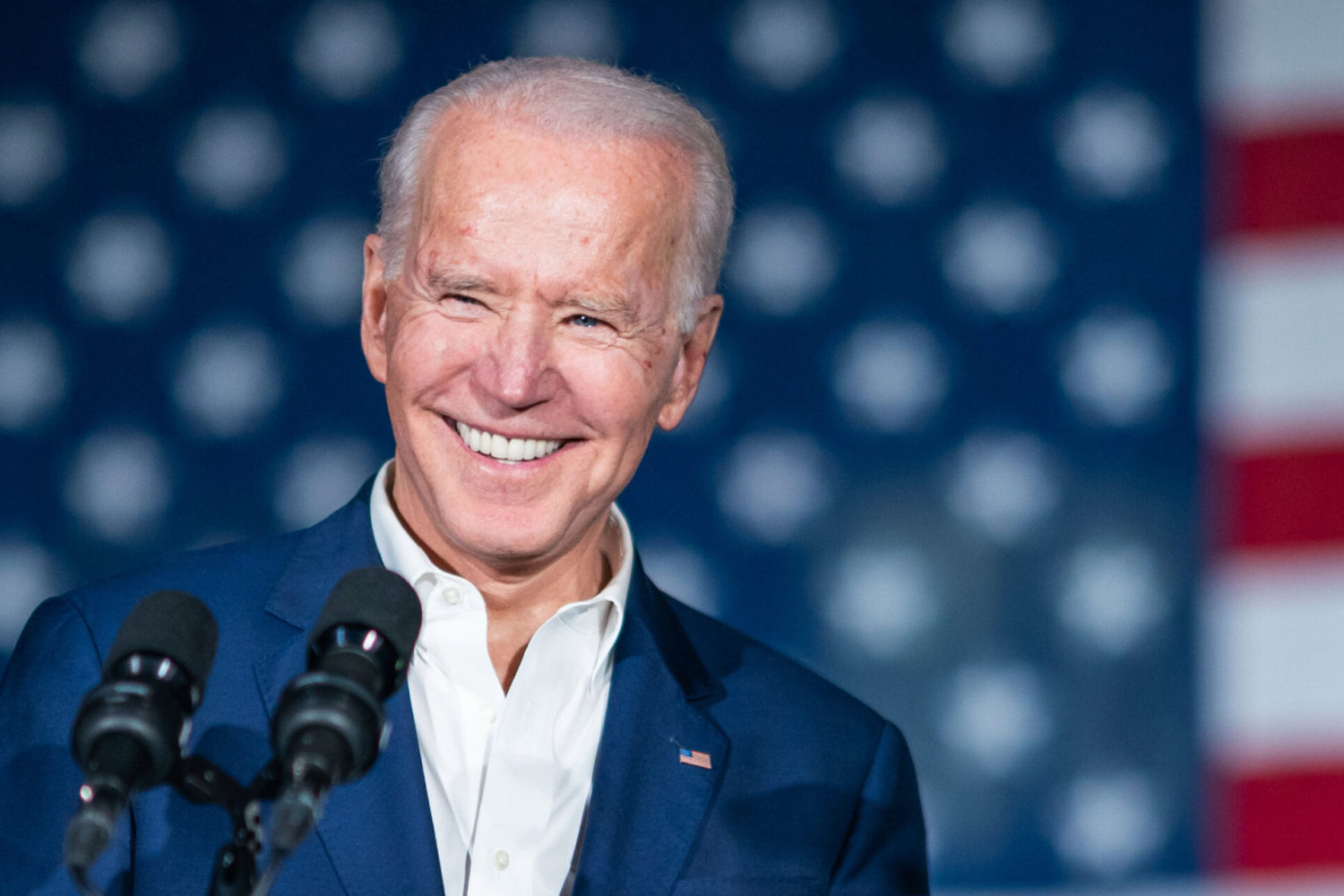

Top Tax Accountants

Need advice on your taxes? These accountants were on our most recent list of top wealth advisers, in the January 2024 issue; they received the most votes from other financial professionals in the region. Almost all are certified public accountants (CPAs) or enrolled agents (EAs) and not only can handle tax returns but also can often suggest ways to reduce your taxes. We’ve noted when they have certain other credentials, such as a law degree (JD) or certifications in financial planning (CFP and PFS).

Courtney Adam

Turner Leins & Gold, Vienna

Jeremy Bendler

Bendler & Company, Bethesda

Sharon Berman, CFP

BDO, McLean

Lisa Blackmore

Aprio, Rockville

Steven M. Braunstein

Snyder Cohn, North Bethesda

Daniel Cohen

Marcum, Rockville

Walter H. Deyhle

GRF CPAs & Advisors, Bethesda

Brett Donahue

Huey & Associates, Herndon

Gary P. Fitzgerald, PFS

Fitzgerald & Co. CPAs, Vienna

Brian Gershen

CohnReznick, Bethesda

Harry A. Harrison

Aprio, Rockville

Joan Holtz, CFP, PFS

BDO, McLean

Robert Hottle, PFS

Baker Tilly, Tysons

Shawn M. Howard

Citrin Cooperman, Bethesda

Bryan Hunt

Centreville

Gabrielle Kaufman

RSM, Gaithersburg

Sam Klausner

Klausner & Company, Arlington

Robert Kopera

Aprio, Rockville

Howard Kramer

KWC, Alexandria

Jaime K. Lawson, PFS

Baker Tilly, Tysons

Debora E. May, CFP

Councilor Buchanan & Mitchell, Bethesda

Krystal McCants

YHB, Falls Church

Dawn McGruder

McGruder Group, Fairfax

Brad L. Mendelson

Mendelson & Mendelson, Potomac

Brian P. Morrison

CST Group, Reston

Marnette Myers, JD

Prager Metis, Tysons

Jonathan Nichols

Huey & Associates, Herndon

Lauran I. Penn, PFS, CFP

Snyder Cohn, North Bethesda

Walter C. Pennington

Dembo Jones, North Bethesda

John M. Persil

CST Group, Reston

Richard L. Philipson, PFS

PFK O’Connor, Silver Spring

Brian K. Pollack

Lanigan Ryan, Gaithersburg

Carolyn C. Quill, JD

Thompson Greenspon, Fairfax

Matthew J. Radford

CohnReznick, Bethesda

Rebecca Rohe, CFP, PFS

Rohe Tax Services, Clarksburg

Joseph J. Romagnoli

CST Group, Reston

Steve Rose

RoseMcKenna, DC

Pete Ryan

Ryan & Wetmore, Bethesda, Vienna, and Frederick

Erica Schmitz

Schmitz Rini & Associates, Great Falls

Brett Scola, CFP, PFS

RSM, Gaithersburg

Crystal Stewart

DeLeon & Stang, Leesburg

Jennifer Sarajian Stone

Andersen, McLean and DC

Keegan Stroup

Andersen, McLean and DC

Joel C. Susco

Withum, Bethesda

William H. Thomas IV

Withum, Bethesda

Kisha N. Ward, CFP, PFS

K. Ward & Co., DC

Jeffrey Weintraub

Dembo Jones, North Bethesda

Brian Wendroff

Wendroff & Associates, Arlington

Andrew M. Youhas, JD

Youhas & Associates, Arlington

Photographs in photo-illustration of tax forms: car by Kindel Media/UNSPLASH; Tax Documents BY Kelly Sikkema/UNSPlaSH; Woman and baby by Andrea Piacquadio/UNSPLASH; HVAC BY Oksana Shufrych/Getty Images.

This article appears in the April 2024 issue of Washingtonian.