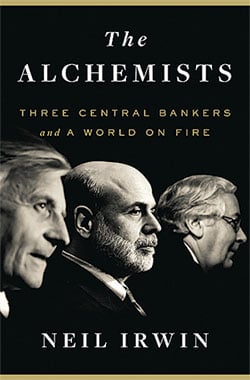

Neil Irwin, a Washington Post economics columnist, covered the Fed and Treasury Department through the worst of the recent financial crisis. His reporting, supplemented by trips around the world to interview central bankers, has grown into a fascinating portrait of the hidden world of governments’ central banks. The Alchemists traces the role of these banks, from 17th-century Sweden to their modern incarnation and the unique gatherings of the world’s most powerful bankers in places such as Jackson Hole and Basel. We spoke with Irwin about his insights.

Why call central bankers the alchemists?

Hundreds of years ago, the alchemists were people who tried to figure out how to turn ordinary materials into gold. They included cranks, but they also included some of the most brilliant scientists. It’s been said Sir Isaac Newton wasn’t the first of the modern scientists but the last of the alchemists. Here’s the thing, though: It was all for naught. As it turns out, a group of economists imbued with the power of the state and a printing press can create money from thin air more effectively than the alchemists ever could. And the people whom society grants that power are the central bankers.

How independent is the Federal Reserve from the US government?

It’s an unwieldy structure. A Fed official told me, “If you went to Harvard Business School and drew the management structure of the Fed system on the board, they’d flunk you out.” You have 12 reserve banks, each with its own board of directors full of local businesspeople and bankers. Their presidents have their own authority but are also overseen by the board of governors in Washington, who are presidential appointees. So it’s kind of a mess, but all those different nodes of power and authority do have benefits in both keeping the organization insulated from raw political influence and ensuring that a full range of views is heard. A reserve-bank president in Kansas City who spends all his time with bankers and businesspeople there is going to have a different view of the economy from one in New York who spends his time dealing with financial markets.

Why focus on Ben Bernanke of the Federal Reserve, Jean-Claude Trichet of the European Central Bank, and Mervyn King of the Bank of England?

The simple answer is they were at the center of this story of how the world economy has been upended. Bernanke became lender of last resort to the world in 2008 and has guided the largest economy through a halting recovery. Trichet deployed once-unthinkable tools to keep half a century of progress toward a united Europe from reversing itself, though he had less success than his successor, Mario Draghi, has had. The British economy isn’t as large as the US or Eurozone, but London is among the most important financial centers and King was a crucial participant in the rescues of 2008 and then pushed a premature pivot to fiscal austerity that has dragged down the British economy since 2010. The three shared the unique bonds and burdens of having the world economy in their hands.

We all know Bernanke. Who’s the most powerful person at the Fed we don’t know?

Dan Tarullo. He’s a former Georgetown law professor, technically just one of seven governors. But he runs bank supervision, which arguably makes him the most powerful bank regulator in the world. He can make life miserable for Wall Street titans like Jamie Dimon and Lloyd Blankfein.

This article appears in the May 2013 issue of The Washingtonian.

Publisher:

Penguin Press HC

Price:

$29.95