Emily White spotted the listing on a Friday night in January. A

three-bedroom detached house in DC’s Brookland neighborhood—exactly what

she was looking for.

She immediately contacted her agent, who arranged

for White, a 29-year-old University of the District of Columbia employee,

and her boyfriend to visit the property the next morning. When White

arrived at 10:30 am, she was surprised to see another pair of potential

buyers already inside. “It had only been on the market for 12 hours,” she

says. By the end of the open house on Sunday, more than 100 people had

visited the property and four offers had come in.

White and her boyfriend raced to put together an offer of their

own. It included an escalation clause, which increased their bid to

$105,000 above the asking price. But it wasn’t enough. They lost the house

to an all-cash buyer who was willing to close on the property within a

week.

If you’re not in the real-estate market yourself, you probably

haven’t even noticed. But for would-be homebuyers, stories like White’s

have become increasingly familiar. Last spring, a couple won a bidding war

over a house in Gaithersburg by agreeing to adopt the seller’s dog. In

December, a four-bedroom, four-bath fixer-upper along Northeast DC’s H

Street corridor attracted 168 offers in two weeks. The following month, a

penthouse in Chevy Chase sold for $8 million—the highest price ever paid

for a Washington-area condominium.

While Washingtonians were distracted by the 2012 presidential

campaign and Redskins quarterback Robert Griffin III’s knee injury, a

funny thing happened: The local real-estate market snapped back to

life.

After plummeting by a third during the housing bust, area

real-estate values have increased by 14 percent since hitting bottom in

2009, according to the S&P/Case-Shiller Home Price Index. Only in five

cities, including Phoenix and Detroit—which suffered steeper declines in

the downturn—have prices rebounded more strongly. Sales volume is up, and

properties are now selling faster—and for closer to their list prices—than

at any time since 2005. And in certain neighborhoods, a pop of pent-up

demand and a historic shortage of inventory have created market

conditions—bidding wars, escalation clauses—that resemble the frantic days

of the real-estate boom.

“This is real,” says developer Jim Abdo. “Buyers are suddenly

finding themselves in a situation where they are having to compete for

real estate again.”

But with memories of the housing crisis still fresh, the burst

of activity has triggered concerns. How did competition for property get

so intense so fast? Are current appreciation rates sustainable—or are we

headed for another bubble?

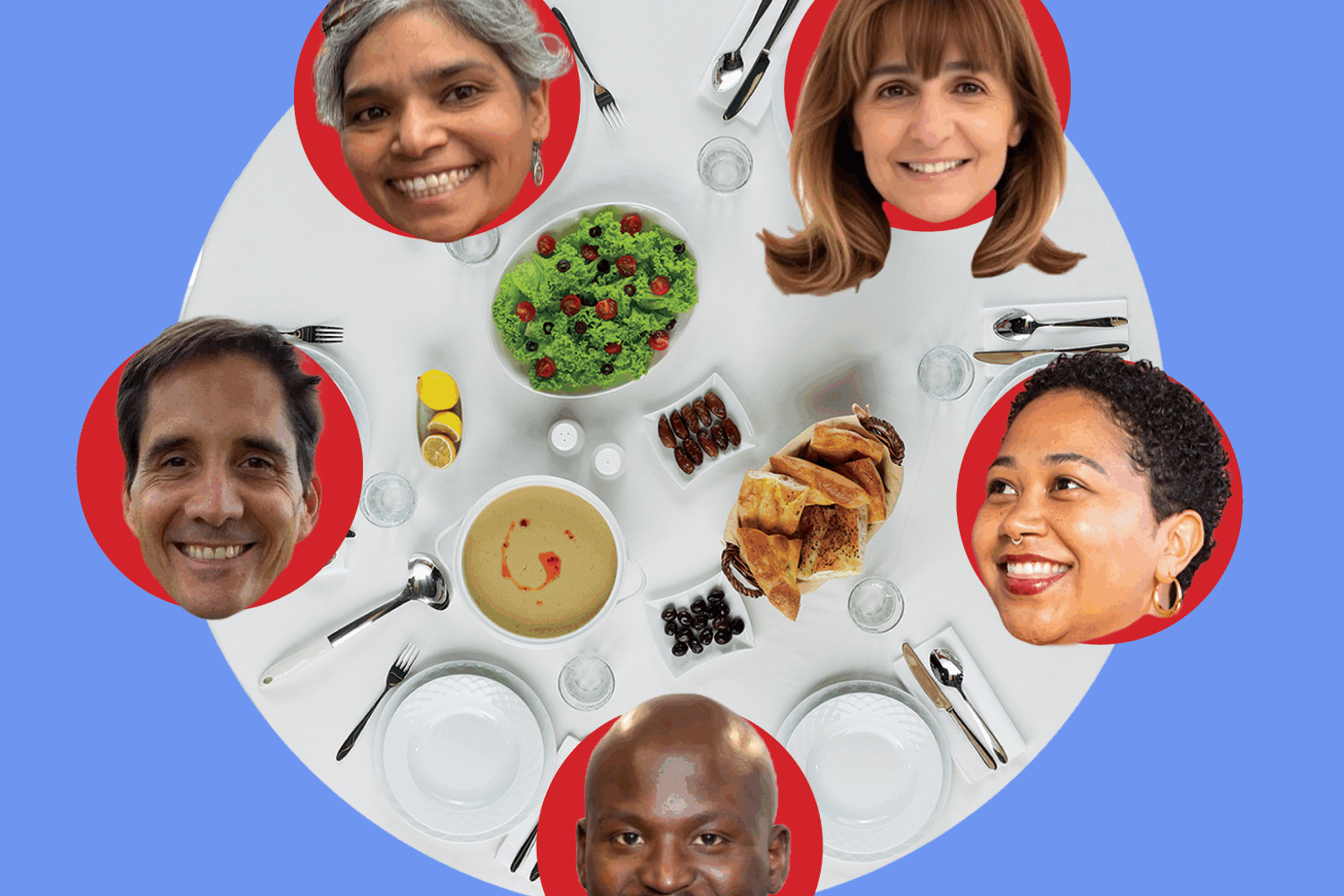

We analyzed data and talked to dozens of economists,

developers, builders, mortgage experts, and real-estate agents to

determine where Washington housing prices are headed, what threats could

derail the recovery, and which neighborhoods are best positioned for

long-term growth.

One thing is clear: It’s not a buyer’s market

anymore.

For Juliano Timm, buying a condo feels like the smart thing to

do. The 48-year-old microbiologist recently received a cash gift from his

family, and with interest rates low and the economy improving, real estate

looks attractive again. In mid-January, he began searching for a

two-bedroom for around $500,000 in DC’s Logan Circle, U Street, Dupont

Circle, and Adams Morgan neighborhoods.

He never imagined it would be so frustrating.

Every property Timm has visited has been jammed with competing

buyers. He began checking online listings several times a week, but even

then, properties are getting snatched up before he has time to put an

offer in—sometimes just days after they list. “I’ve been looking for a

month, but it’s felt like a year,” Timm says. “I never thought it would be

this bad.”

As the seat of the federal government, Washington enjoys

special access to Uncle Sam’s generosity. Federal spending makes up nearly

40 percent of the region’s economy, a subsidy that was never more useful

than during the Great Recession. While the national jobless rate reached

10 percent in the darkest days of the downturn, local unemployment never

exceeded 7 percent. This resilient job market—and perhaps the excitement

of President Obama’s arrival—has attracted a wave of young people to the

nation’s capital. The local population of 25-to-34-year-olds jumped by

more than 17 percent from 2006 to 2012. Many are well educated and work in

high-paying jobs.

Over time, the stable economy and record-low interest rates

have lured many young renters into buying. They prefer condos in

fashionable urban corridors—such as DC’s Columbia Heights or Ballston in

Arlington—where grocery stores, bars, and Metro are all within walking

distance. Also fueling the demand are empty-nesters who want to trade

their suburban home for a smaller place in a walkable “urban” community

like downtown Bethesda.

But while demand for condos has remained firm over the last few

years, the supply of new units has plummeted. When the real-estate market

collapsed, many condominium projects in the pipeline were converted into

apartments. Lenders, many of whom got pummeled during the bust, refused to

finance new developments. The number of new condos hitting the local

market fell by nearly 90 percent from 2007 to 2011. Says Abdo: “When

nothing is being built—we are talking about the spigot being turned

off—and you still have consumption taking place, eventually those

inventories just evaporate.” By December, the area’s inventory of unsold

homes reached its lowest level for that month in nearly a

decade.

Meanwhile as prices have started to rise, investors have

flooded the market again, making all-cash offers on properties they intend

to rent out or flip. With more buyers chasing fewer properties,

competition has grown fierce. In December, properties in three popular DC

markets—Penn Quarter, Columbia Heights, and the U Street corridor—sold, on

average, at or above their listing prices. By comparison, in 2005—the peak

of the boom—homes in the District sold, on average, for 99 percent of

their listing prices.

The result? Hot condo markets have driven real-estate values

sharply higher in certain inside-the-Beltway neighborhoods. Median prices

in Columbia Heights and Mount Pleasant surged by 32 percent over the past

three years; values around U Street and in Shaw jumped by 27 percent.

Prices increased by 11 percent in Ballston and 7 percent in downtown

Bethesda over the past year alone.

Says agent Diana Hart: “I have not written an offer in the last

month that did not contain an escalation clause.”

It’s not only condos that are scarce in today’s market. Leslie

Friedson, a Long & Foster agent, spent two years helping a client hunt

for a single-family home in an upscale neighborhood off 16th Street in

upper Northwest DC. When letters, phone calls, and unannounced visits

failed to unearth a seller, Friedson got creative. She drew up an offer of

more than $1 million and dropped it on the doorstep of a house that wasn’t

even on the market.

The ploy worked. Friedson is negotiating with the owner over a

price. But her experience highlights the dynamic driving today’s market

for single-family homes. “I have many more buyers right now than I have

houses to put them in,” Friedson says.

By the end of 2012, the area’s inventory of single-family homes

was at its lowest since 2005. The shortage of listings can be traced back

to the housing bust, says John Heithaus, chief marketing officer for the

real-estate research firm MRIS. Area home values dropped by 34 percent

from 2006 to 2009, leaving many owners today under water and unwilling to

sell until they have enough equity in their homes to turn a profit. Others

are waiting for values to improve further so their property will fetch a

higher price. Low inventory also creates a vicious cycle: Many potential

sellers simply can’t find a property right now that they’re interested in

buying.

Just like in the condo market, this lack of inventory has

created cutthroat competition in desirable neighborhoods. “I’m seeing

multiple offers everywhere,” says Brian Block, managing broker at RE/MAX

Allegiance in McLean. Buyers are making offers that aren’t contingent on

home inspections or are tossing in perks, such as renting the home back to

the seller for free while they prepare to move out. Many agents are

working their broker contacts to find properties before they list and cut

deals for them off-market.

The market is strongest in close-in neighborhoods with good

schools and manageable commutes, especially in Northern Virginia. In the

past three years, median home values have jumped by 19 percent in Fairfax

County, 17 percent in Alexandria, 13 percent in Arlington, and 8 percent

in Montgomery County.

The pent-up demand and historic inventory shortage means prices

will continue to grow this year. But as rising home values allow more

owners to list their properties and as new condo developments begin

hitting the market in the next 18 to 24 months, prices will start to level

off, says Alexander Paul, national research director for Delta Associates.

Annual price growth will revert to its long-term average of 2.5 to 3.5

percent within the next five years, says James Bohnaker, an economist at

Moody’s Analytics.

What may feel like a return of housing-boom chaos is actually a

natural rebalancing of the market, he says: “The housing cycle is picking

up again to get back to an equilibrium.”

Despite the positive momentum, the real-estate market still

faces considerable headwinds. Record-low mortgage rates have juiced the

housing recovery by making homebuying more affordable. The Federal

Reserve’s bond-buying campaign, coupled with strong global demand for US

Treasury securities, drove average 30-year fixed mortgage rates from 6.8

percent in October 2008 to 3.6 percent in January of this year. But Keith

Gumbinger, a vice president at the mortgage company HSH Associates, says

30-year fixed mortgage rates could drift back up to 6 percent or higher as

the economy improves in the next three to four years.

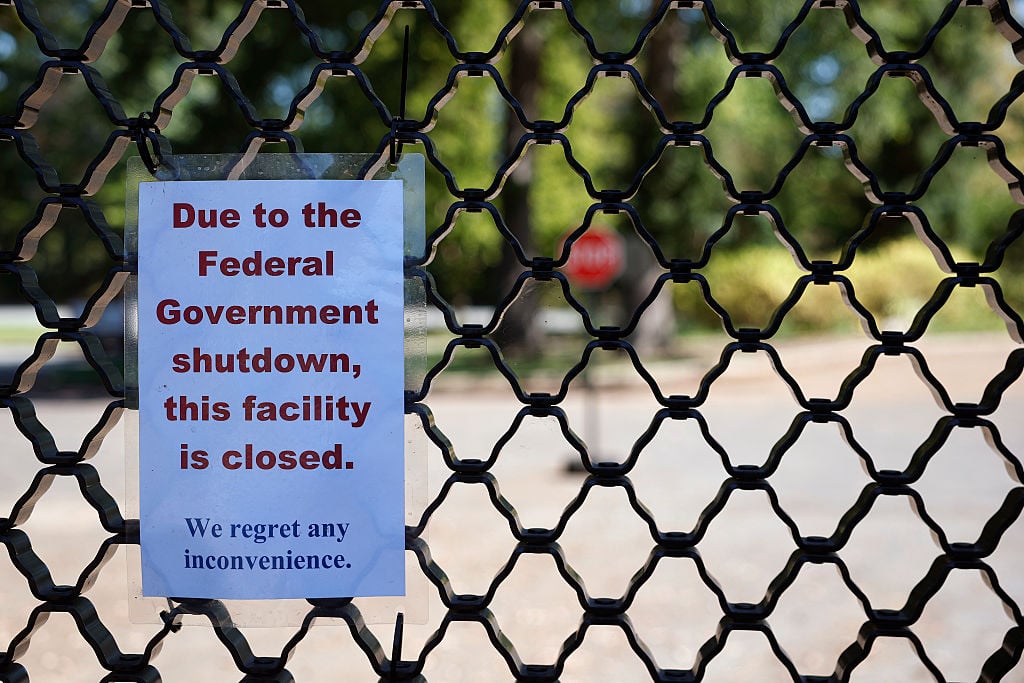

A more immediate threat is “sequestration”—the $1.2 trillion in

federal spending cuts over the next ten years that Congress imposed to

address the $16-trillion national debt. The cuts kicked in automatically

on March 1. No agency will be hit harder than the Department of Defense,

which would have $43 billion hacked off its budget for the next six

months. Unless an alternative agreement is reached, the cuts will ripple

through the local economy, forcing layoffs at the Pentagon and

defense-contracting firms and possibly eroding demand for

housing.

The sequester underscores a fundamental concern about

Washington’s housing market. Federal spending has long been the backbone

of the local economy, providing the job and income growth that drives home

prices up. Nine cents out of every federal dollar spent remains in the

region. And from 2000 to 2010, federal payroll and procurement spending

increased by an average of 8 percent a year, according to Stephen Fuller,

director of George Mason University’s Center for Regional

Analysis.

But as massive deficits intensified pressure to shrink

government, federal payroll and procurement spending fell from 2011 to

2012. “The federal government was certainly the [economic] driver for the

last decade,” Fuller says. “It stopped being the driver in

2010.”

Even with a smaller boost from Uncle Sam, economists say

Washington will have sufficient job and population growth to sustain a

stable, healthy housing market in the long term. Over the next five years,

the area will lose 22,000 federal jobs but gain 55,000 jobs in home

construction and 39,000 in education and health care, Fuller says. Still,

that won’t be enough for Washington’s economy to match its prior growth

rates. “We used to do two points better than the US [economy],” Fuller

says. “Now we are just going to do a fraction of a point

better.”

Anyone who follows the news understands that home prices can

rise and fall just like any other financial asset. But another broad

housing bubble is unlikely to form in the area—at least in the near term,

Bohnaker says. The lending practices that created the boom have largely

vanished. Lenders—who once handed out exotic mortgages to anyone who

walked through the door—are now required to assess that a borrower has the

ability to repay the loan. The secondary market for mortgage-backed

securities, which fueled the demand for subprime loans, is virtually

nonexistent, says Guy Cecala, publisher of Inside Mortgage Finance.

And a new federal agency, the Consumer Financial Protection Bureau,

has been established to shield Americans from dangerous lending

products.

Nevertheless, financiers are always inventing ways to extend

credit, and the market’s appetite for risk will increase over time. It’s

unlikely that risky mortgage products—or real-estate booms—are gone for

good. If home prices in Washington are still increasing by double digits

five years from now, your bubble radar should be flashing.

Just outside the Beltway on Leesburg Pike in McLean, workers

haul building materials behind the glass facade of a six-story structure.

When it’s completed, the development will include 400 apartments, a

Walmart grocery store, and a 24-hour health club. About 300 hundred yards

away, a pair of gray cement bridges glide into an unfinished Metro

station. Late this year, the Silver Line will zip passengers from here to

downtown DC in less than 15 minutes. A couple of blocks east, cranes

deliver two-by-fours and metal beams to men in hardhats. In 2014, this

26-story luxury apartment building will have a rooftop pool and a communal

walk-in refrigerator where residents can store their grocery

deliveries.

It doesn’t look like much now, but the future of the local

housing market is slowly emerging in Tysons Corner.

About six years ago, government and business leaders launched

an initiative to transform Tysons from a car-dependent suburb into “the

downtown of Fairfax County.” The master plan calls for four new Metro

stops, condos, townhouses, apartments, shops, restaurants, athletic

fields, bike paths, public art, and an elementary school.

The Washington area’s population is expected to increase by

nearly a third, to 7 million, by 2040. Researchers predict growth will be

strongest around places like Tysons—walkable clusters of businesses,

restaurants, and housing tied to public transit. The movement toward these

“town centers” is fueled by the region’s worst-in-the-nation traffic

congestion and high housing costs. As such centers expand, their housing

stock will become increasingly urban—think small townhouses and condos in

densely populated neighborhoods—which will help keep prices under

control.

The Metropolitan Washington Council of Governments, an

association of local governments that addresses regional development

issues, has designated 139 of these centers that are poised for growth,

including DC’s H Street corridor, Columbia Pike Town Center in Arlington,

and downtown Frederick. As town centers grow more popular, the Washington

area will feel less like one large city feeding a network of suburbs and

more like a series of smaller cities dispersed throughout the region. It’s

in these town centers where demand for housing—and therefore home-price

appreciation—is expected to be strongest.

The rise of activity centers will cut demand for what was once

the symbol of success in America: the quiet suburban home with a two-car

garage and a big back yard. “It doesn’t mean that there is nobody who

wants a suburban cul-de-sac house,” says John McIlwain of the Urban Land

Institute. “But those values are going to be much flatter than the values

around these suburban town centers.”

Several corridors are ripe for particularly impressive housing

demand over the coming decades. DC’s developing NoMa district, north of

Capitol Hill, will see a 184-percent increase in employment by 2040—more

than six times the region’s average. Silver Spring’s population will

balloon by nearly three times the regional average over the same period.

And don’t forget Tysons, which is projected to more than triple its

population by 2050, to 66,000, and add nearly 90,000 jobs.

Says Jay Klug, a principal with JBG Rosenfeld Retail, which is

spearheading a mixed-use development in Tysons Corner: “Tysons is making

this transition from a very suburban, automotive-dependent place to a real

urban area.”