The secret’s been out for a while that the District’s housing market continues to challenge lower-income residents. But a new, interactive report from the Urban Institute shows just how staggering the decline in affordable units has been and why the city’s steady influx of young professionals is fueling the trend.

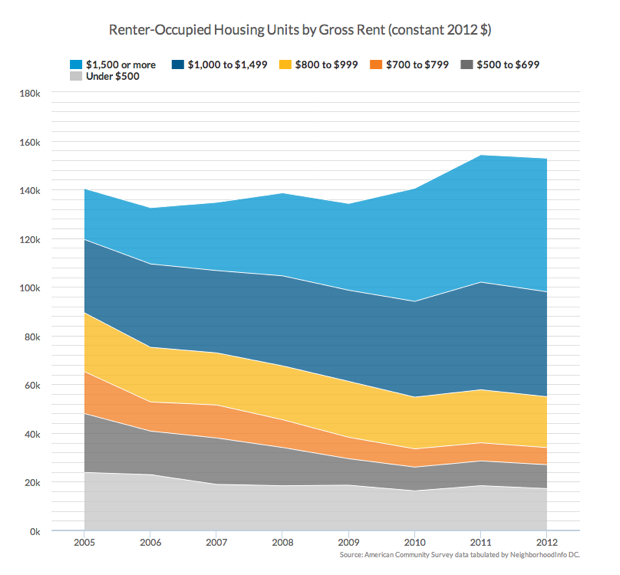

Nine years ago, more than 65,000 rental units across DC charged less than $800 per month. In 2012, that figure plummeted to about 34,000 units. Meanwhile, the number of apartments that go for at least four digits a month has grown to two-thirds of the rental market. Of the 152,845 apartments counted in the Urban Institute’s study, 64 percent cost over $1,000 per month, and 35 percent feature rents of at least $1,500.

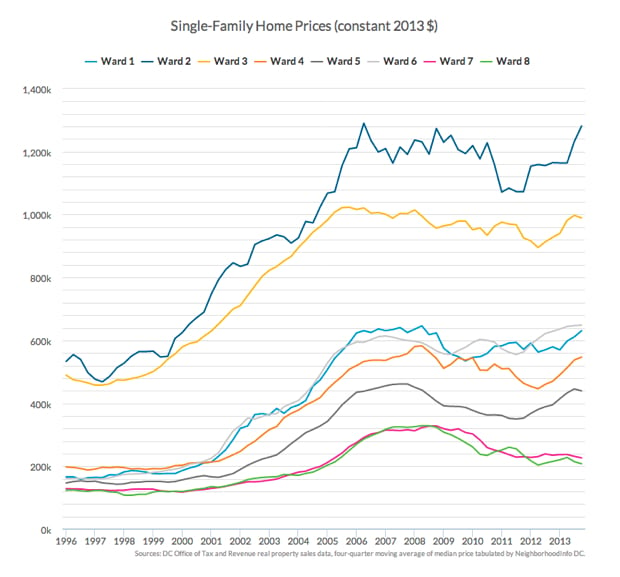

Home ownership also remains out of reach for an increasing number of District residents, the study finds. The District’s housing prices did not lose much in the 2007-2009 recession and have continued to stay high, especially in Ward 2, where the median house costs $1.28 million, and Ward 3, where the median home sale is $989,100. While housing costs have stayed up, DC has swelled with new, high-priced units. Between 2002 and 2013, the city added 600 condominium developments, 4,000 single-family homes, and 680 apartment buildings, many of which saturate newly expensive neighborhoods like 14th Street, Northwest, Shaw, Navy Yard, and H Street, Northeast.

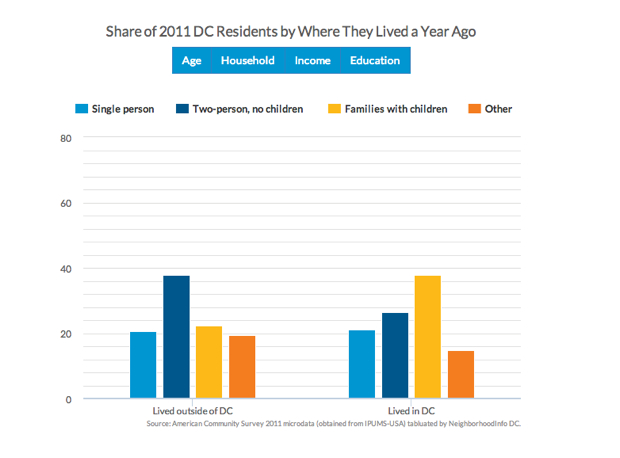

So, who’s fueling the building boom and soaring rents? A lot of the new housing demand can be attributed to DC’s growing population of so-called “millennials”—people between 18 and 34 years old. The District’s population has gone from 572,000 in 2000 to 646,449 in 2013, according to the Census Bureau. According to the Urban Institute, of people who moved into the District in 2011, 67 percent were in that age range. People age 35 and older accounted for 52 percent of people who already lived in DC for at least a year. New residents also tended to be mostly single people or couples without children, compared to 38 percent of existing residents in families with children. High-income earners also made up a 36.9 percent plurality of newcomers.

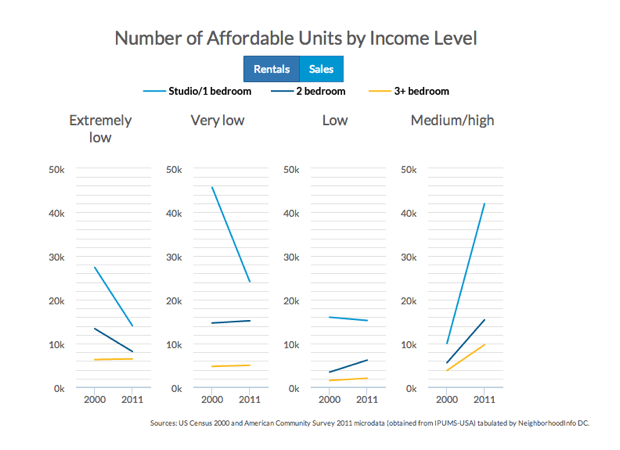

On the flip-side, the number of apartments available to people making low, very low, or extremely low incomes collapsed between 2005 and 2011. The number of studios and one-bedrooms available to people with extremely low incomes—30 percent or less than the median—dropped by nearly half over that span. But for people with medium and high incomes, the supply of studios and one-bedrooms quadrupled over that six-year period.

Find Benjamin Freed on Twitter at @brfreed.